You’ve finally decided to kiss PPOs goodbye.

Congrats! Your margins are about to stop bleeding.

But now comes the next reality check: how the heck do you keep patients from bailing when they find out you’re “out of network”?

Spoiler: it’s not about throwing discounts at them like it’s a dental Groupon.

It’s about giving them a real reason to stay through a smart, structured approach to affordability.

You’ve got two power plays on the table:

- In-house membership plans that build loyalty and predictability

- Third-party financing that kills sticker shock and boosts case acceptance

But here’s the thing nobody tells you: these two tools aren’t interchangeable.

They solve different problems, for different patients, at different stages of care.

Use the wrong one at the wrong time, and you’ll either tank your profits or confuse the heck out of your patients.

This isn’t about picking “the best.” It’s about knowing which lever to pull, and when.

So let’s break it down between dental membership plans vs financing, system by system, no fluff, no filler.

Table of Contents

The Tool That Fits Your Practice Depends on Your Patient Base and Profit Strategy

There’s no one-size-fits-all answer here. Membership plans and third-party financing solve different problems for a fee-for-service practice.

If you treat them the same, you’ll waste money, confuse patients, and miss out on case acceptance.

The real power comes from knowing your patient demographics and aligning your payment tools with your profitability goals.

Membership Plans Lock in Loyalty. Financing Removes Payment Friction.

Let’s start with what each tool actually does because they aren’t interchangeable.

- In-house dental membership plans are best for patients who are uninsured, retired, self-employed, or just sick of insurance games. These plans help cover routine, preventive care in exchange for an annual or monthly fee. Think: two cleanings, exams, x-rays, and a little discount love on treatment.

- Third-party financing is your go-to for large, unexpected, or elective treatments, like implants, Invisalign, crowns, cosmetic work. This is where sticker shock kills case acceptance unless you offer a “pay later” option.

Let’s look at the data:

- Practices with membership plans see an average annual production of $1,276 per member, compared to $469 for uninsured patients who pay as they go. That’s a 52% increase in patient value, according to Kleer (now Clerri).

- On the financing side, 78% of patients say they’re more likely to accept dental treatment if financing is available. And 45% have delayed care because of upfront costs, according to CareCredit’s Industry Report.

So here’s the play:

- Use membership plans to build loyalty and lock in preventive visits (hello, predictable recurring revenue).

- Use financing tools to convert high-value treatment plans into accepted cases without price objection wars.

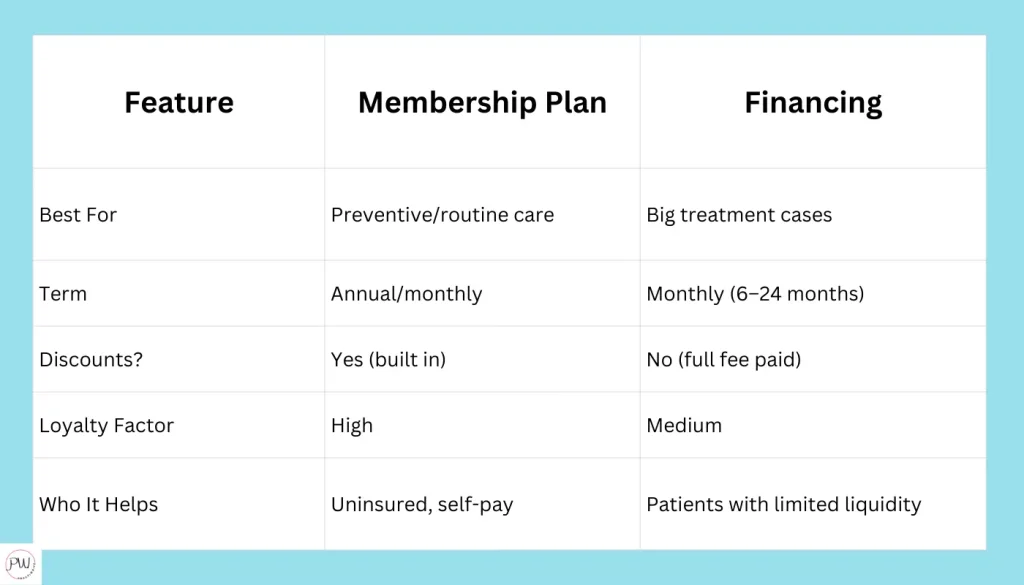

Membership vs. Financing

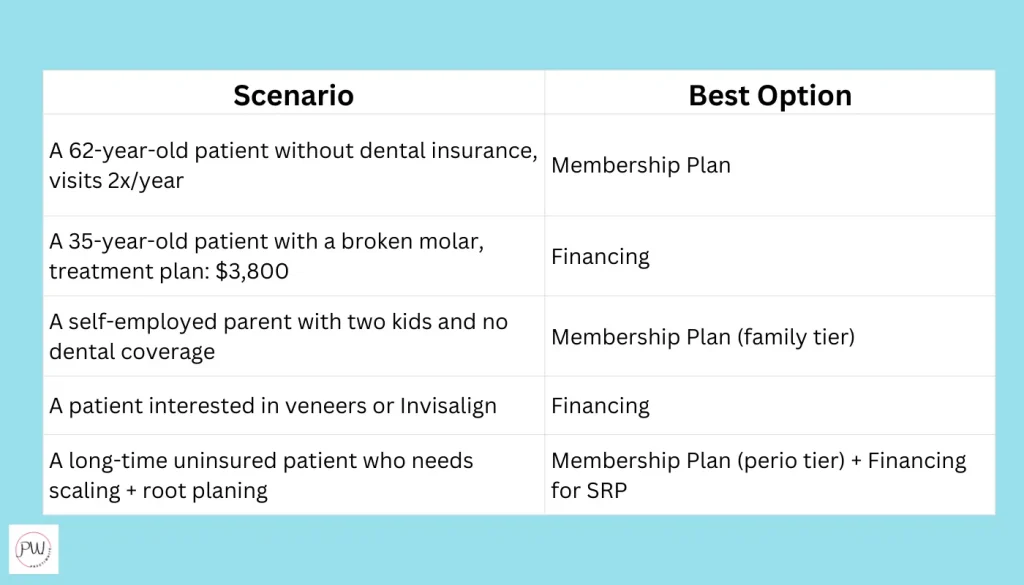

Still not sure what to offer your patients? Use this as your cheat sheet:

If you’re trying to use one tool to do both jobs, you’re going to either lose money or lose patients.

And neither is the vibe we’re going for in a thriving FFS practice.

Why Your In-House Dental Membership Plan Isn’t Just a “Discount Club”

If you’re treating your membership plan like a glorified coupon, you’re leaving cash on the table. A real membership plan is a loyalty engine, but only if it’s priced right, built smart, and legally sound.

Don’t Build a Discount Plan. Build a Revenue Stream

Too many dentists get spooked by going out-of-network and slap together a quick “10% off everything” membership plan like it’s a panic button.

That’s desperation, not a strategy.

The truth? A well-built membership plan can outperform your insurance reimbursements.

But it needs to be designed like a real product, not a favor to patients who no longer get PPO rates.

What that means:

- No race-to-the-bottom pricing. You’re not here to undercut insurance. You’re here to deliver care without the handcuffs.

- Benefits that matter. Cleanings, exams, x-rays, yes. Add-ons for periodontal patients or families? Even better.

- Predictable, recurring revenue. Paid monthly or annually, with renewals built in. No chasing claims, no waiting on reimbursements.

Data backs it up:

- Patients on a membership plan accept 2–3x more treatment and visit more often than uninsured patients, according to BoomCloud.

- Typical membership plans report an average patient retention rate of 81% for members. This is significantly higher than uninsured or PPO patients.

Tier It. Price It. Protect Your Margins.

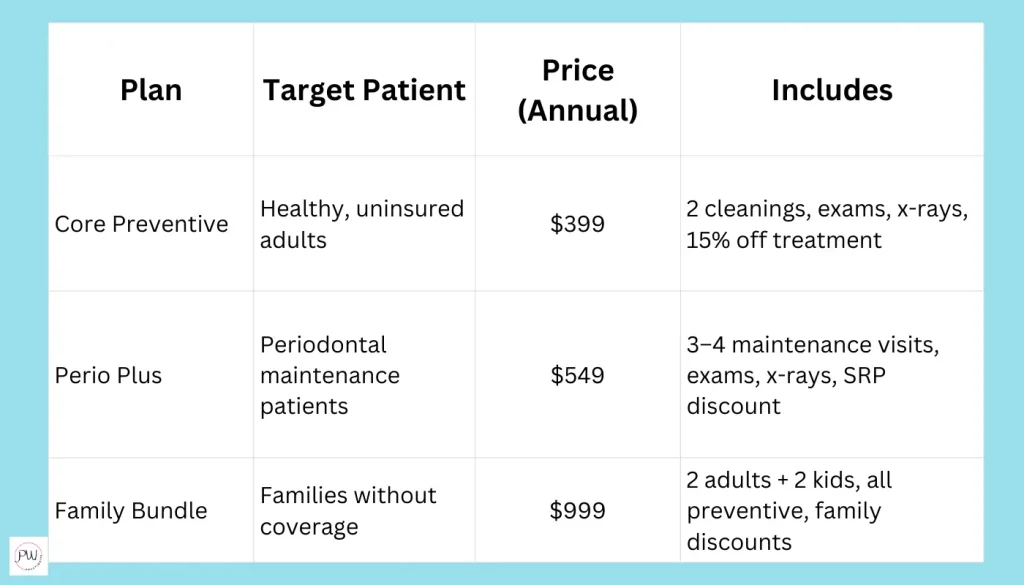

One size never fits all. A smart membership plan has tiers that reflect real patient needs and maintain profitability.

Example structure:

Want to sweeten the deal without tanking your margins? Add simple perks:

- Whitening touch-ups

- Priority booking

- Small gift cards for auto-renewals

The moment your plan becomes “unlimited dentistry for $39/month,” (which BTW, please don’t) you’ve turned into a dental Netflix with zero profit.

Legal Structure Matters. And No, Your Front Desk Shouldn’t Be DIY’ing This

This is where a lot of practices get blindsided: your membership plan is a legal product. And depending on how you build and market it, it might accidentally look like you’re trying to act like an insurance company.

Which brings a whole mess of compliance issues.

Key legal factors:

- State regulations vary. Some require you to register your plan or use a third-party administrator.

- You need clearly written terms and conditions, refund policies, and eligibility clauses.

- Your plan must clearly state: “This is not insurance.”

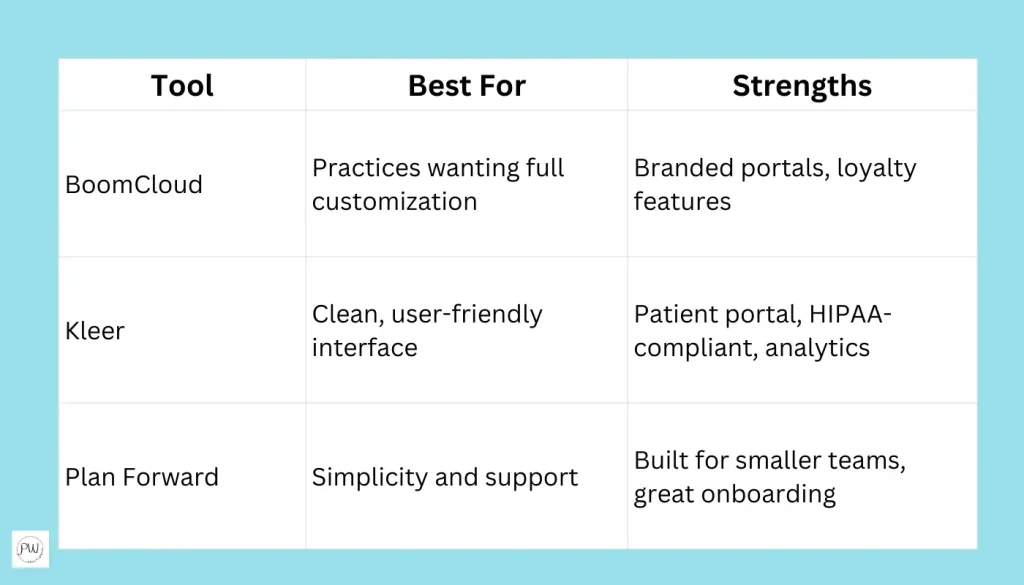

Tools like DentalHQ, BoomCloud, and Plan Forward specialize in compliant plan setup and admin.

And just to cover our bases here:

Practiwrite does NOT provide legal advice. What is written here should NOT be considered financial or legal advice. You’ll need to consult a qualified attorney familiar with healthcare contracts and dental membership laws in your state before launching any in-house plan.

Automate or Die (or At Least Burn Out)

Membership plans shouldn’t live in a spreadsheet. If you’re asking your front desk to track renewals, bill manually, and follow up with every patient, you’re setting them (and yourself) up for burnout.

Automate the whole thing with platforms built for dental. The top contenders:

Most of these tools handle:

- Recurring billing

- Plan renewals

- Legal compliance

- Real-time analytics

- Member communication

You shouldn’t be managing your plan. You should be marketing it.

When Third-Party Financing Is Your FFS Secret Weapon

If your high-value cases are getting “I’ll think about it” and ghosted vibes, it’s probably not your clinical skills. It’s sticker shock.

Third-party financing doesn’t just help patients afford care. It gets you paid faster, boosts case acceptance, and keeps treatment moving.

Sticker Shock Is Real and It’s Killing Your Case Acceptance

We all know that look. You present a $6,500 treatment plan and the patient suddenly goes cross-eyed.

They nod politely.

They need to “check their calendar.”

Translation: they’re out.

Now imagine this: Instead of walking out, they hear, “We have a way to split that into affordable monthly payments. No credit cards, no stress.”

That’s what financing does.

And this isn’t just for full arches or high-end veneers. Even a $1,200 crown can be a dealbreaker if you expect payment in full today.

Which Financing Partners Won’t Eat Your Profits Alive?

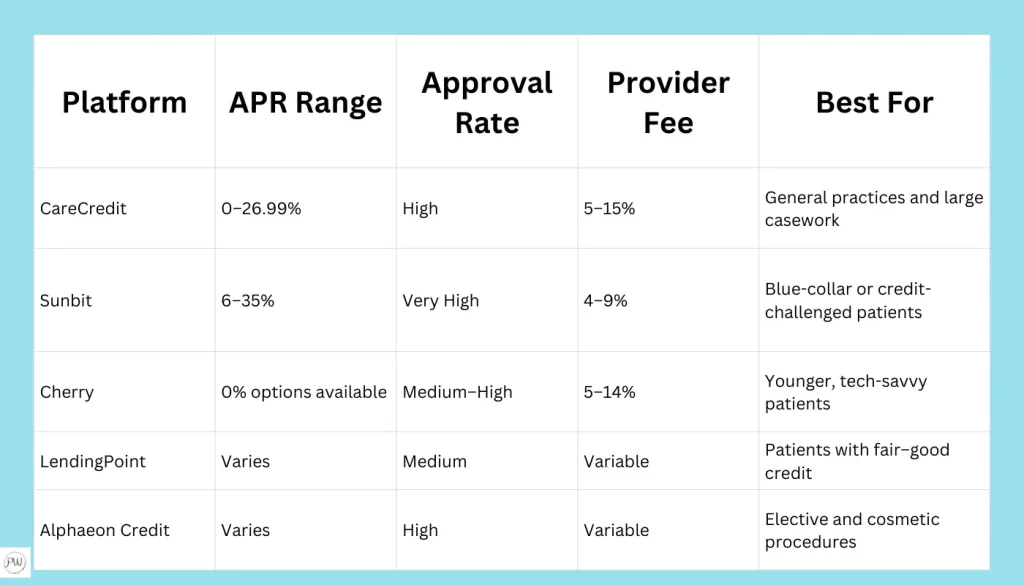

Let’s talk about the big players. Not all third-party financing is created equal and the wrong partner can chew through your margins with fees and fine print.

Here’s a simplified breakdown of the top contenders:

Choose 1–2 options that match your patient demographic. You don’t want to offer a buffet of financing. Your team will never keep it straight, and confused patients don’t say yes.

How to Present Financing Without Feeling Slimy

Most dentists fumble financing because they either:

- Avoid bringing it up until the patient says “no,” or

- Hand over a pamphlet and hope for the best

That’s not how this works.

Here’s how to frame it like a pro:

- “Most of our patients choose to pay monthly for this kind of treatment. We work with a trusted financing partner that can get you approved today with no upfront cost.”

- “The total cost is $4,200. With our financing option, it can be as low as $120 a month. And the best part is, we can get an answer in 2 minutes.”

Let your treatment coordinator (not your front desk) walk them through it. Have the tablet ready. Keep it seamless.

And whatever you do, don’t call it a loan. Call it a payment option or monthly plan. Language matters.

Use Financing to Speed Up Acceptance, Not Delay It

This is where things get strategic. If you present financing before the “I can’t afford that” objection, you:

- Normalize it

- Reduce anxiety

- Increase treatment acceptance right on the spot

You don’t need to wait for a patient to say no. You just need to build it into your case presentation like it’s part of the offer.

Because it is.

No One Talks About the Hybrid Model, But You Should

The smartest fee-for-service practices aren’t choosing between membership plans or financing. They’re using both.

Strategically.

A hybrid model gives patients options, builds long-term loyalty, and increases case acceptance without discounting your work.

For the dentists who are still on the fence about whether to go all in on an FFS model, having a hybrid option brings the best of both worlds.

-Nicole Kolesar

The “Lexus or Toyota” Model: Give Patients a Choice, Not a Lecture

Ever been to a car dealership where they tell you, “You can only lease OR buy, no other options”?

No, because that would be dumb.

Same with your financial options. Your patients aren’t all the same.

Some want predictability.

Some need flexibility.

Some want both.

That’s why the real FFS power move is offering a hybrid payment model:

- Membership plans for routine, preventive care; ideal for building trust and retention

- Financing for treatment plans; perfect for bigger, emotionally charged purchases

By offering both, you’re not confusing patients. You’re empowering them.

A patient walks in with no insurance? Great, here’s a clean, affordable membership option.

They need two implants? Awesome, we can help them break that into payments.

They want both? Even better, now they’ve got a system.

Make the Options Obvious and Easy to Say Yes To

The most effective practices don’t hide their payment solutions in the fine print. They build it into the experience.

- Add a financial options page to every treatment plan

- Include a “Join the Plan” link in your post-op emails

- Train your front desk to ask: “Do you prefer to pay monthly, or would you like to save with our membership plan?”

Make it stupid easy to choose.

Want Higher Case Acceptance? Let Patients Mix and Match

Here’s where it gets fun: the real FFS rockstars let patients combine the two options when it makes sense.

Example:

- Patient joins your $399 membership plan (includes cleanings, x-rays, etc.)

- Later that year, they need $3,600 in treatment

- You offer 12-month financing on the treatment portion only

- They feel taken care of, you retain their loyalty, and you get paid in full

That’s not just a win-win. That’s FFS model magic.

And remember, options ≠ discounts.

You’re not discounting your care.

You’re structuring affordability in a way that protects your margins and respects your value.

5 Common Mistakes That Kill Profitability (and How to Avoid Them)

It’s easy to screw this up. One “nice guy” discount here, one missed renewal there and suddenly your FFS practice looks like a charity.

These are the most common financial option fails, and how to keep your margins tight while still serving patients well.

Mistake #1: Underpricing Your Membership Plan

This is the most common (and most painful) mistake we see, dentists setting their membership fees based on guilt or guesswork.

“I don’t want to charge too much…”

“They used to pay less on insurance…”

Stop.

If your membership plan doesn’t cover your actual costs plus at least a 30% margin, it’s not helping your practice. It’s draining it.

Let’s break it down:

- Cleanings = $100 each (your internal cost)

- Exam = $75

- X-rays = $40

That’s $315 in direct cost before you’ve even done a filling. If you’re pricing your plan at $299/year just to sound affordable congrats, you’re losing money before you even touch a handpiece.

Set your fees based on value and margin, not on beating insurance rates.

Need help pricing? Platforms like Kleer and BoomCloud include profitability calculators for this exact reason.

Mistake #2: Treating Financing Like a “Last Resort”

Here’s what too many dentists do:

- Present treatment

- Wait for the patient to panic about the price

- THEN mention financing as a lifeline

That’s backward.

You should be presenting financing as part of the plan, not a desperate backup. The sooner you normalize it, the faster patients say yes.

And the more confidently your team can present it.

Fix it: Build it right into your case presentation.

“This treatment is $4,600. Most of our patients choose to break that up into monthly payments. Want me to show you what that looks like?”

Zero shame. Just clarity.

Mistake #3: Letting Your Front Desk Fumble the Conversation

Your front desk staff are probably amazing at scheduling and customer service. But if they’re not trained to explain membership plans or financing confidently, you’re leaving money on the table and confusing patients in the process.

Common issues:

- “I think it’s around $30 a month, but I’m not sure what’s included…”

- “We might offer CareCredit? I think there’s a brochure…”

Nope.

Fix it: Train like it’s a product launch. Give them:

- One-sheets with plan benefits and pricing

- Financing scripts for different case types

- Regular role-playing with treatment coordinators

Your admin team should speak about financial options with the same confidence your assistants talk about flossing.

Mistake #4: Offering Financing to Everyone, All the Time

This one’s sneaky and expensive. Some dentists start using financing like a catch-all solution for every patient and every case.

Result? You start eating provider fees on everything, even when patients could’ve paid in full or used a membership plan.

Fix it: Use financing strategically.

- Big case? Offer financing.

- Routine work? Offer the membership plan.

- Cash-pay patient? Ask before assuming.

You may also consider offering a short-term, in-house payment plan (e.g. 2–3 months max) for good-fit patients to avoid provider fees altogether. Just be sure to get it in writing.

Mistake #5: Forgetting to Track Renewal Rates and Drop-Offs

Membership plans are only as good as your renewals. If you’re not tracking who’s expiring, who’s dropped, and who never signed up in the first place, you’re probably losing more revenue than you think.

Fix it:

- Use software that handles auto-renewals and alerts (like Plan Forward)

- Have your team run a monthly membership audit

- Incentivize renewals; give patients a reason to stay on board

Because here’s the truth: if you’re replacing expired members every month just to stay flat, you’re spinning your wheels.

A Final Word: Dental Membership Plans vs Financing? Do Both. Strategically.

This isn’t Coke vs. Pepsi. It’s “Which one goes best with the meal?”

Membership plans and financing serve different roles. When used together, they build a system that increases patient retention and revenue without the PPO middleman skimming your margins.

Stop Choosing. Start Structuring.

If you’ve made it this far, you already know the truth:

- Membership plans bring in consistent revenue, build patient loyalty, and make preventive care accessible.

- Financing increases case acceptance on high-dollar treatments and eliminates sticker shock.

But here’s where most practices screw up; they treat these tools like options instead of infrastructure.

This is not an “either-or” play.

It’s a strategic combo:

- A membership plan that keeps your preventive flow rock solid

- Financing options that take the “no” out of large treatment plans

- A trained team that knows how to present both without blinking

- Systems that automate renewals, approvals, and follow-up

That’s not just insurance-alternative thinking. That’s business model design.

Start Building a Payment Strategy, Not Just Payment Tools

If you only remember one thing from this post, let it be this:

Most dentists have tools. The successful ones have systems.

You don’t need 17 discount plans and 5 financing brochures.

You need one solid membership structure.

One clear financing option.

And a practice that knows exactly how and when to use them.

System > tools. Every time.

Your Next Move

You don’t have to figure this all out on your own. And you definitely don’t need to waste another year trying to duct-tape together a plan that might work.

Let’s map it out. Together.

Schedule a call to get your free Dental Practice Roadmap.

Learn the impact of SEO on your practice AND how to get where you want to be, with a clear strategy.

10+ year content strategist, writer, author, and SEO consultant. I work exclusively with dental practices that want to grow and dominate their local areas.