Your dental practice is being slowly strangled by insurance companies, and you know it.

Every year, reimbursement rates drop while administrative demands increase. You’re seeing more patients to maintain the same income, rushing through appointments, and compromising on the care you’d prefer to deliver.

The PPO contracts you signed to “guarantee patient flow” have become golden handcuffs that dictate everything from your fees to your treatment recommendations.

Here’s what most practice management consultants won’t tell you: this system is designed to extract maximum value from your expertise while minimizing what you’re paid for it.

Insurance companies profit when you accept lower fees and see higher volumes. You’re the one absorbing the stress, the overhead, and the liability.

But there’s an alternative that growing numbers of dentists are choosing: fee-for-service practice.

When you plan the move to a fee-for-service dental practice transition, it means you set your own fees, treat patients according to your clinical judgment rather than insurance limitations, and get paid directly for the value you provide.

No more write-offs.

No more pre-authorizations for procedures you know are necessary.

No more explaining to patients why their insurance won’t cover the treatment they actually need.

The transition isn’t simple, and it’s not right for every practice. You’ll need to communicate differently with patients, restructure your billing systems, and possibly lose some patients who prioritize insurance coverage over quality care.

But practices that make this transition successfully report higher profitability, greater job satisfaction, and the ability to practice dentistry the way they were trained to practice it.

Let’s walk through exactly how to evaluate whether fee-for-service makes sense for your practice, plan the transition strategically, and implement the systems needed to succeed.

The goal isn’t to convince you to make this change. It’s to give you the information you need to make the right decision for your practice and your patients.

Key Takeaways:

Insurance is draining your profits

PPOs reduce revenue by up to 60% due to write-offs and administrative burden.

Fee-for-service gives you control

You set your fees, treat based on clinical need, and get paid upfront.

Transitions work best gradually

Start by dropping low-value plans, training staff, and educating patients.

You’ll earn more and enjoy practice again

FFS practices report higher profits, lower burnout, and more patient referrals.

Patients still have options

Membership plans, financing, and cash discounts make care accessible without insurance.

What Is Fee-for-Service Dentistry?

Fee-for-service dentistry is what dental practice looked like before insurance companies decided they should control your treatment decisions and fees. It’s a practice model where patients pay you directly for services, and you determine appropriate fees based on your costs, expertise, and the value you provide, not what some insurance company in another state thinks your work is worth.

Definition and Core Principles

In a fee-for-service practice, the financial relationship is between you and your patient. Period. You provide treatment, they pay your fee, and insurance companies—if involved at all—reimburse the patient directly.

You’re not contracted with insurance networks, which means you’re not bound by their fee schedules that often reimburse at 50-70% of reasonable fees.

The core principle is simple: the person receiving the care pays for the care. This eliminates the middleman who profits by paying you less while charging patients more for “coverage” that often excludes the treatments they actually need.

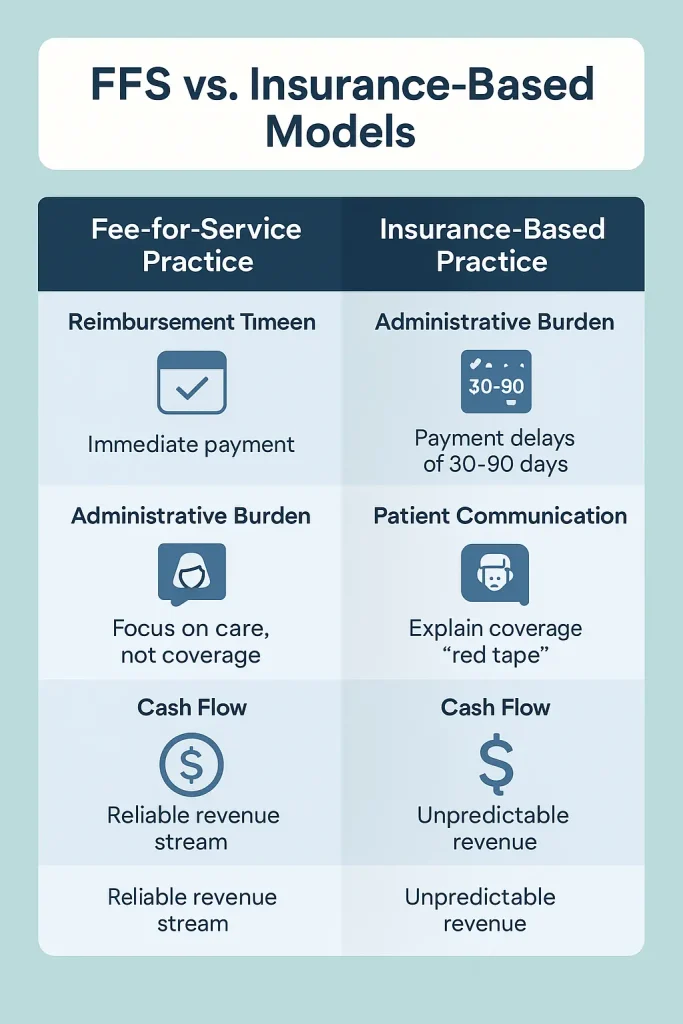

FFS vs. Insurance-Based Models

The differences are stark:

Insurance-Based Practice:

- Fees dictated by insurance contracts

- Treatment options limited by coverage policies

- Administrative staff spend 40-60% of time on insurance tasks

- Average 30-45% write-offs on standard fees

- Pre-authorizations required for many procedures

- Payment delays of 30-90 days common

Fee-for-Service Practice:

- You set fees based on actual costs and value

- Treatment recommendations based solely on clinical need

- Direct payment at time of service

- No write-offs or contractual adjustments

- No pre-authorization delays

- Immediate cash flow

According to the ADA’s 2024 Survey of Dental Practice, dentists in heavily insurance-dependent practices report spending an average of 18% of their time on insurance-related administrative tasks rather than patient care. That’s nearly one full day per week lost to paperwork that generates no revenue.

Types of FFS Models

Pure Fee-for-Service: Patients pay the full fee at time of service. You don’t file insurance claims. Patients handle their own reimbursement if they have coverage.

This model has the lowest administrative overhead but requires patients comfortable with upfront payment (hint, hint…affluent patients).

Courtesy Billing: You file insurance claims as a service to patients, but patients pay your full fee at time of service. Insurance reimbursement goes directly to the patient. This balances convenience with cash flow protection.

Hybrid Models: You drop the most restrictive insurance plans while maintaining contracts with a select few that offer reasonable reimbursement rates. Many practices use this as a transition strategy, gradually reducing insurance dependence over 12-24 months.

The choice depends on your patient demographics, local market conditions, and risk tolerance. According to Dental Economics’ 2024 practice survey, 73% of successful FFS transitions used a hybrid approach rather than dropping all insurance immediately.

Here’s what insurance companies don’t want you to know: the average dental insurance plan hasn’t meaningfully increased its annual maximum benefit since the 1970s. Most plans still cap benefits at $1,000-$1,500 per year—the same amount they covered 50 years ago.

Meanwhile, your costs for lab work, supplies, equipment, and staff have increased with inflation. The math doesn’t work, and it’s getting worse every year.

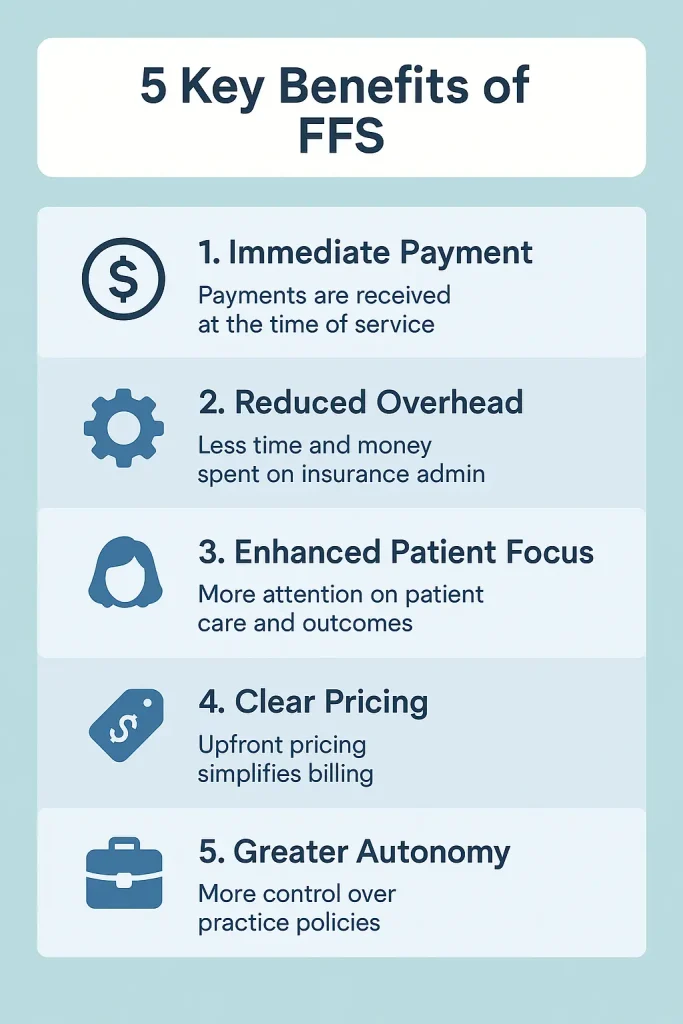

5 Key Benefits of Fee-for-Service Dentistry

The benefits of fee-for-service practice aren’t theoretical—they’re measurable improvements that practices document within months of transitioning. Here’s what actually changes when you stop letting insurance companies run your practice.

Enhanced Clinical Autonomy

When you’re not bound by insurance limitations, you can practice dentistry the way you were trained. No more checking coverage before recommending ideal treatment. No more explaining to patients why their insurance considers a necessary procedure “cosmetic” or “not medically necessary.”

Insurance companies employ dentists specifically to deny claims and limit coverage. Their job is to save the company money, not optimize your patients’ oral health.

The American Dental Association’s 2024 claims analysis found that insurance companies initially deny 23% of submitted claims, forcing practices to spend an average of 45 minutes per denial on appeals—time that could be spent treating patients.

In fee-for-service practices, treatment decisions happen between you and your patient based on clinical need. Practices report that comprehensive treatment plan acceptance rates increase from an average of 58% (insurance-dependent practices) to 76% (fee-for-service practices) because patients understand they’re investing in their health rather than maximizing insurance benefits.

Improved Financial Predictability

Insurance reimbursements are unpredictable and declining. The 2024 Dental Economics Fee Survey showed that PPO reimbursements dropped an additional 8% compared to 2023, while practice overhead costs increased 12%. You’re earning less while spending more which, as I’m sure you know, is a recipe for financial stress.

Fee-for-service practices eliminate this squeeze. When patients pay at the time of service, you have immediate cash flow and can predict revenue based on your schedule rather than hoping insurance companies pay their contracted amounts on time. Practices that transition to fee-for-service report 40% less month-to-month revenue variance and 25% higher profit margins within the first year.

Simplified Operations

Insurance administration is a profit-killer disguised as a business necessity. The average practice employs 1.2 full-time equivalent staff members solely for insurance-related tasks: verification, pre-authorization, claims submission, denial management, and collections.

At an average salary of $45,000 per position, that’s $54,000 annually spent on tasks that generate zero revenue.

Fee-for-service practices redirect this administrative capacity toward patient care and practice growth. Staff who previously spent their days on hold with insurance companies can focus on patient education, treatment coordination, and building relationships that drive referrals. Practices report that administrative costs drop 22% within six months of transitioning away from insurance dependence.

The complexity reduction is equally valuable. Instead of tracking dozens of different fee schedules, coverage limitations, and prior authorization requirements, your team manages one transparent fee structure. Patient financial conversations become straightforward discussions about treatment value rather than insurance archaeology expeditions.

Stronger Patient Relationships

Insurance-based practices create artificial barriers between dentist and patient. You’re constantly explaining what “their insurance covers” rather than what they actually need. Patients leave confused about whether you recommended treatment because it’s necessary or because it’s covered.

Fee-for-service practices eliminate this confusion. When patients pay directly, they understand they’re purchasing your expertise and care, not maximizing insurance benefits. This creates stronger relationships built on trust rather than coverage limitations.

The time difference is significant. Without insurance constraints, you can spend quality time educating patients about their oral health and preventive strategies. The ADA’s 2024 patient satisfaction survey found that patients in fee-for-service practices rated their dentist communication 34% higher than patients in insurance-dependent practices.

Higher satisfaction translates to business results: fee-for-service practices generate 72% of new patients from referrals compared to 43% in insurance-dependent practices. When patients value your care enough to pay directly, they enthusiastically recommend you to others.

Professional Satisfaction

Dental school taught you to diagnose problems and provide optimal treatment. Insurance companies want you to provide the cheapest treatment they can justify covering. This tension creates the burnout that’s driving dentists out of practice at record rates.

The American Dental Association’s 2024 wellness survey found that 67% of dentists report feeling “trapped” by insurance requirements that conflict with their clinical judgment. Fee-for-service practitioners report 43% lower burnout scores and 89% would not return to insurance-dependent practice models.

The autonomy extends beyond clinical decisions. You control your schedule, your fees, and your practice policies without insurance company interference. You can invest in continuing education, new technology, and practice improvements without wondering whether insurance will reimburse appropriately.

A client of mine, who transitioned her San Diego practice to fee-for-service in 2023, summarizes it:

“I spent 15 years fighting with insurance companies about what my patients needed. Now I just provide it. My stress is down, my income is up, and I’m practicing dentistry instead of insurance administration.”

These benefits compound over time. As you build a patient base that values quality care over insurance coverage, your practice becomes more profitable, more enjoyable, and more sustainable. The question isn’t whether fee-for-service offers advantages—it’s whether you’re ready to claim them.

5-Step Fee-For-Service Dental Practice Transition Roadmap

Transitioning to fee-for-service isn’t something you announce on Monday and implement on Tuesday. Practices that succeed follow a systematic approach that protects cash flow while building the foundation for long-term success. Here’s the roadmap that works.

Step 1: Practice Assessment

Before you can transition away from insurance dependence, you need to understand exactly what you’re transitioning from. Most dentists have never calculated the true cost of their PPO participation and the numbers are usually worse than expected.

Analyze Your Current Patient Demographics: Pull reports showing patient payment patterns, treatment acceptance rates, and visit frequency. Identify patients who consistently choose optimal treatment over “what insurance covers” and those who decline necessary care due to cost.

The patients investing in comprehensive care are your fee-for-service candidates. The patients who only want cleanings covered by insurance probably aren’t.

Look at your active patient count versus insurance plan participation. If you’re contracted with eight insurance plans but 70% of your revenue comes from two plans, you’re already identifying which contracts actually matter to your practice.

Financial Audit of Insurance Contracts: Calculate your true reimbursement rate for each insurance plan. Don’t just look at fee schedules. Also factor in write-offs, denied claims, and delayed payments. Include administrative costs: staff time for verification, pre-authorization, claims submission, and denial management.

A typical analysis reveals that practices lose 40-60% of their standard fees to insurance companies when all costs are included. One of my clients in his Phoenix practice discovered they were netting $420 for crown procedures they billed at $1,200 after accounting for contractual write-offs and administrative costs. That’s a 65% reduction from their actual fee.

Market Evaluation Checklist: Research your local market demographics. Fee-for-service succeeds in areas where patients have discretionary income and value quality healthcare. Look at median household income, education levels, and existing competition. If there are already several successful fee-for-service practices in your area, that’s validation that the market supports this model.

Analyze your location’s insurance penetration. Areas with many government employees or large corporations often have patients heavily dependent on specific insurance plans. Rural areas might have limited insurance options but also limited patient capacity for out-of-pocket expenses.

Step 2: Strategic Planning

Timeline Development (12-24 Months): Successful transitions happen gradually. Start by identifying your lowest-reimbursing insurance plans and those with the most administrative burden. Plan to drop one plan every 3-4 months while monitoring financial impact and patient retention.

Create milestone checkpoints every quarter to evaluate progress. Set specific metrics: patient retention rates, average production per patient, and cash flow consistency. If retention drops below 75% or cash flow becomes unstable, slow the transition pace.

Fee Schedule Creation: Develop a fee schedule that reflects your actual costs plus reasonable profit margins. Factor in your overhead, desired income, continuing education costs, and equipment investments. Many practices discover their insurance-contracted fees don’t even cover their true costs per procedure.

Research local market rates but don’t automatically match them. If you’re providing superior care with better materials and more time, your fees should reflect that value. The goal isn’t to be the cheapest option—it’s to be the best value for patients who prioritize quality.

Cash Flow Projections: Model different transition scenarios with conservative patient retention estimates. Plan for 15-25% patient attrition during the transition and calculate how this impacts your monthly revenue. Build financial cushions to cover potential cash flow gaps during the first 6-12 months.

One of my clients’ Portland practice created three financial models:

- Best case (10% attrition)

- Likely case (20% attrition)

- And worst case (35% attrition).

Having backup plans for each scenario allowed them to proceed confidently and adjust tactics when reality fell between their best and likely case projections.

Step 3: Team Preparation

Staff Training on Value Communication: Your team’s ability to communicate value determines transition success. Insurance-trained staff instinctively lead with “what your insurance covers.” Fee-for-service staff lead with “what’s best for your health” and handle financial discussions confidently.

Develop scripts for common scenarios: explaining out-of-network benefits, presenting treatment costs, handling price objections, and discussing payment options. Role-play these conversations until responses feel natural. Staff discomfort with financial discussions kills case acceptance rates.

Train your team to reframe cost conversations. Instead of “$1,200 for a crown,” teach them to say “This restoration will last 15-20 years, making it about $5 per month to maintain your tooth.” Patients understand value better than price.

Payment Processing Setup: Implement systems that make payment convenient. Accept multiple payment types: cash, checks, credit cards, and digital payments. Partner with financing companies like CareCredit or LendingClub for patients who need payment plans.

Create clear payment policies and train staff to present them consistently. Patients should understand payment expectations before treatment begins, not when they’re checking out. Surprises create complaints and bad reviews.

Patient Education Materials: Develop materials that explain your fee-for-service model and its benefits. Create comparison charts showing the limitations of typical insurance plans versus comprehensive care.

Help patients understand that insurance is cost-sharing, not healthcare—their benefits haven’t increased meaningfully in 50 years while their oral health needs have become more complex.

Produce simple explanations of out-of-network benefits and how patients can maximize reimbursement from their insurance companies. Many patients don’t understand they can still use their benefits even when you’re not contracted with their plan.

Step 4: Patient Communication

90-Day Notification Process: Give patients adequate notice before dropping insurance plans. Send written notification explaining the change, the reasons behind it, and how it benefits them. Follow up with phone calls for high-value patients to address questions personally.

Frame the change positively: you’re making this transition to provide better care without insurance limitations. Emphasize that they can still use their benefits—they’ll just receive reimbursement directly rather than having the insurance company pay you reduced rates.

Benefit-Focused Messaging: Focus communications on what patients gain, not what they lose. Highlight longer appointment times, access to better materials, no pre-authorization delays, and treatment recommendations based on their needs rather than insurance coverage.

Share specific examples: “Previously, your insurance limited us to amalgam fillings for back teeth. Now we can use tooth-colored composite that matches your natural teeth and doesn’t contain mercury.” These concrete benefits help patients understand the value of your transition.

Addressing Common Concerns: Prepare responses to predictable questions: “Will this cost me more?” “Why should I pay out-of-pocket when I have insurance?” “Can you still file my insurance?” Train your team to address these concerns with empathy and facts.

Develop patient-specific retention strategies. Call your highest-value patients personally to explain the change and answer questions. These relationships often determine whether your transition succeeds financially.

Step 5: Implementation & Optimization

Gradual vs. Complete Transition Options: Most successful practices choose gradual transitions, dropping one insurance plan every quarter while monitoring results. This approach protects cash flow and allows course corrections if patient retention is lower than expected.

Some practices in favorable markets choose immediate transitions, dropping all insurance contracts simultaneously. This approach requires larger financial reserves but eliminates the administrative complexity of managing multiple payment models during the transition period.

Performance Monitoring: Track key metrics weekly during transition: patient retention rates, new patient acquisition, average production per patient, and case acceptance rates. Monthly reviews aren’t frequent enough to catch problems before they impact cash flow.

Monitor patient feedback closely. Exit interviews with patients who leave can reveal communication gaps or policy issues that need adjustment. Address problems immediately rather than hoping they resolve themselves.

Continuous Improvement: Refine your approach based on real results. If certain insurance plans show higher patient retention, extend those contracts while dropping others. If specific communication strategies improve case acceptance, train all staff on those techniques.

Stay connected with other fee-for-service practices through study clubs or online forums. Learn from their experiences and adapt successful strategies to your practice. The transition never truly ends—you’re always optimizing systems and improving patient relationships.

A dental practice in Seattle exemplifies successful implementation:

“We spent six months planning, twelve months transitioning, and now eighteen months later, we’re seeing 30% fewer patients but generating 40% more revenue. The best part? I actually enjoy practicing dentistry again.”

Insurance Alternatives That Work

The biggest misconception about fee-for-service dentistry is that patients lose all financial assistance when you stop accepting insurance. Smart practices replace insurance dependency with alternatives that benefit both patients and the practice.

These aren’t theoretical concepts. They’re proven strategies generating revenue for thousands of practices nationwide.

Membership Plans

Membership plans are subscription-based healthcare that cuts out insurance companies entirely. Patients pay an annual fee (typically $300-500) directly to your practice and receive preventive care plus discounts on treatment.

It’s Netflix for dental care. Predictable monthly revenue for you, transparent costs for patients.

The numbers prove these plans work. According to the 2024 Dental Membership Plan Report, practices with established membership programs see average revenue increases of 23% within the first year. Members spend 2.3 times more on treatment than non-members because they’re not limited by insurance maximums or waiting periods.

Typical Membership Structure:

- Annual fee of $350-450 for adults

- Includes two cleanings, exams, and routine x-rays

- 15-20% discount on all other procedures

- No waiting periods, deductibles, or annual maximums

- Family plans available with progressive discounts

The business model is straightforward: membership fees cover preventive care costs while generating consistent monthly revenue. Treatment discounts are still profitable because you’re not paying insurance company administrative fees or accepting below-market reimbursements.

A client’s membership program in Austin generates $180,000 annually from 600 members. Even after providing included services, the program nets $95,000 in profit while creating a patient base committed to the practice long-term. Members rarely leave because they’ve invested in annual care.

Platforms like Kleer, BoomCloud, and Dental HQ provide turnkey membership plan management for 8-12% of membership revenue. They handle enrollment, billing, renewals, and patient communication, making implementation simple for practices focused on care delivery rather than subscription management.

Payment Plans and Financing

Modern patients expect payment flexibility, and providing it increases case acceptance dramatically. The key is offering multiple options that protect your cash flow while accommodating different financial situations.

In-House Payment Plans: Structure payment plans that work for your practice economics. For procedures under $1,500, offer 3-6 month payment schedules with no interest. For larger treatments, extend terms to 12 months with modest financing charges that cover administrative costs.

Require 25-50% down payments to demonstrate patient commitment and protect against defaults. Use written agreements specifying payment amounts, due dates, and consequences for missed payments. Treat these as business contracts, not informal arrangements.

Track payment plan performance religiously. If default rates exceed 8-10%, tighten qualification criteria or require larger down payments. Payment plans should increase case acceptance, not create collection problems.

Third-Party Financing Partnerships: Companies like CareCredit, LendingClub, and Alphaeon Credit provide immediate payment to your practice while offering extended payment terms to patients. You receive full payment within 2-3 business days minus processing fees of 3-8%.

These services are particularly valuable for treatment exceeding $2,000 where patients benefit from longer payment terms. Many offer promotional periods with 0% interest if patients meet payment schedules, making expensive treatment more accessible.

The approval process takes minutes, and patients can apply online before their appointment. This eliminates the awkwardness of financial discussions during treatment consultations and allows patients to make informed decisions about their care.

Payment Processing Optimization: Accept every payment method patients prefer: cash, checks, credit cards, digital wallets, and online payments. Each payment option you add increases case acceptance rates. The cost of processing fees is minimal compared to lost treatment revenue.

Implement payment portals where patients can view balances, make payments, and set up automatic payments. This reduces collection calls and improves patient satisfaction by giving them control over their payment timing.

Cash Discounts

Cash discount programs reward patients who pay at the time of service while improving your cash flow. These programs are legal in all states when structured properly—the key is offering true discounts for immediate payment rather than surcharges for other payment methods.

Implementation Strategies: Offer 3-5% discounts for cash, check, or debit card payments made at the time of service. Structure this as a reduction from your standard fee rather than a penalty for other payment methods. The distinction matters legally and psychologically.

Calculate discount percentages based on your credit card processing costs plus a small incentive for immediate payment. If you pay 3% in credit card fees, a 5% cash discount saves you money while rewarding patients for prompt payment.

Promote cash discounts as financial wellness benefits rather than desperation moves. Frame them as rewards for patients who prioritize their healthcare budgets and plan for dental care expenses.

Legal Considerations: Review state regulations regarding discount programs. Some states require specific language in discount advertisements or limit discount percentages. Consult with healthcare attorneys familiar with your state’s requirements before implementing these programs.

Ensure your discount policies don’t violate credit card merchant agreements. Most allow cash discounts but prohibit credit card surcharges. The semantic difference is legally significant even if the financial impact is identical.

Document discount policies clearly in writing and train staff to explain them consistently. Patients should understand discount qualifications before treatment begins to avoid confusion during checkout.

One practice implemented a 4% cash discount program and saw immediate payment rates increase from 67% to 89%. The program generated an additional $2,300 monthly in improved cash flow while reducing collection efforts significantly.

Beyond Traditional Alternatives: Progressive practices are experimenting with cryptocurrency payments, flexible spending account optimization, and employer-sponsored direct reimbursement programs. While these alternatives serve smaller patient segments, they demonstrate the innovation possible when you’re not constrained by insurance company limitations.

The goal isn’t to replace insurance benefits entirely. It’s to provide patients with affordable access to quality care while ensuring your practice receives appropriate compensation for services. When patients have multiple financial options, they’re more likely to proceed with necessary treatment rather than delaying care due to cost concerns.

These alternatives work because they align patient and practice interests: patients receive quality care at transparent prices while practices generate predictable revenue without insurance company interference. It’s healthcare the way it should work—direct relationships between providers and patients based on value rather than coverage limitations.

Overcoming Common Challenges

Every practice considering fee-for-service transition faces the same predictable obstacles. The difference between practices that succeed and those that retreat back to insurance dependency isn’t the absence of challenges—it’s how systematically they address them. Here’s what you’ll face and how to handle it.

Patient Resistance

The biggest shock for most dentists is discovering that patient resistance often comes from unexpected sources. Your most loyal, high-value patients frequently support the transition because they understand quality costs money. The resistance comes from patients who view dental care as a commodity covered by insurance rather than an investment in their health.

Education Strategies: Patient resistance stems from misunderstanding, not malice. Most patients don’t realize their dental insurance hasn’t meaningfully increased benefits since the 1970s while dental technology, materials, and overhead costs have skyrocketed. They’re operating on outdated assumptions about insurance value.

Create simple comparisons showing what $1,000 bought in dental care in 1975 versus today. Explain that their “great dental insurance” covers the same dollar amount as insurance from 50 years ago. This context helps patients understand why insurance limitations no longer match modern dental care costs.

Develop visual aids showing the difference between insurance-driven treatment and optimal treatment. Use actual cases where insurance limitations prevented ideal care or forced compromises in materials or techniques. Patients understand these trade-offs better when they see concrete examples rather than abstract explanations.

Value Communication Techniques: Stop talking about procedures and start talking about outcomes. Instead of “You need a crown,” explain “This treatment will save your tooth and eliminate the pain you’ve been experiencing.” Connect treatment to improved quality of life, not just dental health.

Break down costs in terms patients understand. A $1,200 crown that lasts 15 years costs $6.67 per month—less than most patients spend on coffee. This reframing helps patients see treatment as a reasonable investment rather than a major expense.

Compare your care to alternatives patients readily pay for. Most patients don’t hesitate to spend $1,500 annually on car maintenance to prevent major repairs, but they resist spending the same amount on dental care that prevents far more serious health problems.

One practice in Aurora, Ohio addresses cost objections directly: “I tell patients that quality dental care costs money, just like quality car repair or quality anything else. The question isn’t whether it costs money—it’s whether the cost is fair for the value provided. When they understand what they’re actually purchasing, most patients see the value clearly.”

Cash Flow Management

The transition period tests every practice’s financial resilience. Even successful transitions typically see 15-25% patient attrition in the first six months. Practices that survive this period emerge stronger, but inadequate cash flow planning kills transitions before they can prove successful.

Financial Planning Tips: Build cash reserves equal to 4-6 months of operating expenses before beginning transition. This cushion allows you to maintain service quality and staff during temporary revenue decreases. Practices that attempt transitions without adequate reserves often panic and retreat to insurance dependency when cash flow tightens.

Model conservative scenarios assuming 25% patient loss and plan accordingly. If your practice generates $80,000 monthly and loses 25% of patients immediately, you need systems to operate on $60,000 monthly while rebuilding patient volume. Most practices can reduce some variable costs but fixed overhead continues regardless of patient volume.

Implement aggressive collection policies for outstanding accounts receivable before transition begins. Clean up your books and collect money owed from insurance companies and patients. This improves cash flow entering the transition and reduces administrative distractions during implementation.

Reserve Requirements: Calculate minimum cash reserves based on your specific overhead structure. Fixed costs like rent, insurance, and loan payments continue regardless of patient volume. Variable costs like supplies and lab bills decrease with lower patient volume, but the savings rarely offset revenue reduction completely.

Consider credit lines as backup funding during transition. Banks are more willing to extend credit to profitable practices before transitions than during temporary revenue decreases. Establish these relationships early as insurance against cash flow problems.

Monitor daily cash flow during transition rather than monthly summaries. Weekly cash flow reviews aren’t frequent enough to catch problems before they become critical. Daily monitoring allows immediate adjustments to prevent cash flow crises.

Get Your Team Ready

Staff resistance can sabotage transitions even when patient acceptance is strong. Team members comfortable with insurance administration often fear job security when those tasks disappear. Others worry about patient confrontations over money or doubt their ability to communicate value effectively.

Training Priorities: Retrain staff to think about patient care rather than insurance coverage. Insurance-trained staff instinctively ask “What does your insurance cover?” instead of “What treatment do you need?” This mindset shift requires consistent reinforcement and practice.

Develop specific scripts for financial conversations and practice them repeatedly. Staff discomfort with money discussions kills case acceptance rates. Role-play difficult scenarios until responses feel natural and confident.

Cross-train administrative staff on patient care coordination tasks. As insurance administration decreases, redirect staff toward activities that improve patient experience and support practice growth. This maintains full employment while adding value.

Change Management: Address job security concerns directly. Explain how reduced insurance administration creates opportunities for patient education, treatment coordination, and practice marketing. Frame the transition as career enhancement rather than job elimination.

Involve staff in transition planning to build buy-in and ownership. Staff members who help design new systems are more likely to implement them successfully than those who have changes imposed on them.

Provide regular updates on transition progress and financial health. Staff anxiety increases when they don’t understand how the practice is performing during changes. Transparency about challenges and successes builds confidence and commitment.

One team’s adaptation strategy focused on redefining roles rather than eliminating positions: “Our insurance coordinator became our patient care coordinator. Instead of fighting with insurance companies about coverage, she now helps patients understand treatment options and coordinates care between appointments. She’s much happier, and patients receive better service.”

Reality Check: These challenges are real, and some practices don’t successfully navigate them. The difference between success and failure usually comes down to preparation, realistic expectations, and commitment to working through temporary difficulties rather than retreating at the first sign of problems.

Practices that succeed treat transition challenges as temporary obstacles rather than permanent problems. They maintain focus on long-term benefits while systematically addressing short-term difficulties. This perspective allows them to work through patient attrition, cash flow pressures, and staff adaptation issues that cause other practices to abandon fee-for-service models.

These challenges exist whether you transition or not. Insurance-dependent practices face different but equally serious problems—declining reimbursements, increasing administrative burden, and loss of clinical autonomy. The question isn’t whether challenges exist, but which challenges you prefer to address.

Getting Started: Your Action Plan

Most dentists spend months researching fee-for-service transition and never take the first step. Analysis paralysis keeps practices trapped in insurance dependency while reimbursement rates continue declining. The practices that succeed are those that start moving—imperfectly—rather than waiting for perfect conditions that never arrive.

Immediate Next Steps (7-Day Action Plan)

Day 1: Financial Reality Check: Pull your practice management reports for the last 12 months. Calculate your true reimbursement rate for each insurance plan by dividing actual collections by total production. Include write-offs, denied claims, and delayed payments. Most dentists discover they’re netting 50-65% of their standard fees after all insurance costs are included.

Create a simple spreadsheet listing each insurance contract, annual revenue generated, average reimbursement percentage, and administrative burden (hours per week spent on that plan’s requirements). This data reveals which contracts actually benefit your practice versus those costing more than they generate.

Day 2: Patient Analysis: Segment your active patients into three categories: high-value patients who consistently accept comprehensive treatment, moderate patients who sometimes accept treatment, and low-value patients who only want insurance-covered services. The first group will likely support your transition. The third group probably won’t—and that’s acceptable.

Review patient payment patterns over the past two years. Identify patients who pay promptly, ask questions about treatment options, and seem engaged in their oral health. These patients demonstrate characteristics of successful fee-for-service relationships.

Day 3: Market Research: Research other fee-for-service practices in your area. What services do they offer? How do they communicate their value? What are their fee structures?

This isn’t about copying their approach—it’s about understanding what works in your local market.

Check median household income and education levels in your practice area. Fee-for-service succeeds better in areas where patients have discretionary income and understand the value of professional services. If your market demographics don’t support fee-for-service, consider hybrid approaches that maintain some insurance participation.

Day 4: Team Discussion: Meet with your team to discuss fee-for-service transition possibilities. Gauge their comfort level with financial conversations and identify training needs. Address job security concerns directly—explain how reduced insurance administration creates opportunities for enhanced patient care roles.

Ask team members which insurance plans create the most administrative burden and frustration. Their insights often reveal problems that don’t show up in financial reports but significantly impact practice efficiency.

Day 5: Fee Schedule Development: Calculate your true costs for common procedures including overhead allocation, material costs, and desired profit margins. Many practices discover their insurance-contracted fees don’t even cover actual costs when overhead is properly allocated.

Research local market rates but don’t automatically adopt them. If you provide superior care with better materials and more time, your fees should reflect that value. The goal is fair compensation for quality work, not matching the lowest prices in your market.

Day 6: Legal and Compliance Review: Contact a healthcare attorney familiar with dental practice transitions. Review your insurance contracts for termination requirements—most require 30-90 days written notice. Understand any legal obligations before making commitments to patients or staff.

Research state regulations regarding membership plans, cash discounts, and patient payment programs. Some states have specific requirements that affect how you structure alternatives to traditional insurance.

Day 7: Decision Point: Based on your week of research, decide whether to proceed with transition planning or maintain current insurance participation. This isn’t a permanent decision—practices can always reconsider as market conditions change—but it provides clarity for moving forward.

If proceeding, set specific timelines for each phase of transition. If maintaining insurance participation, identify which plans provide the best value and consider dropping those that don’t meet profitability thresholds.

Key Metrics to Track

Financial Indicators: Monitor collection ratios, days in accounts receivable, and profit margins monthly. Track these metrics for at least six months before transition to establish baselines for comparison during implementation.

Calculate production per patient and case acceptance rates by procedure type. These metrics reveal whether you’re seeing the right patients and communicating value effectively.

Patient Metrics: Track patient retention rates, new patient acquisition sources, and appointment cancellation rates. Changes in these metrics during transition indicate whether your communication strategies are working.

Monitor patient survey responses and online reviews for themes related to cost, value, and service quality. Patient perception drives referrals and long-term success more than clinical excellence alone.

Operational Metrics: Measure time spent on administrative tasks versus patient care. Fee-for-service should increase the percentage of time devoted to revenue-generating activities.

Track staff satisfaction and turnover rates during transition. High-performing team members are crucial for successful implementation, and their departure during transition can derail progress.

Professional Resources and Support

Industry Organizations: The Academy of Dental CPAs provides financial guidance specific to dental practice transitions. Their members understand the unique challenges of fee-for-service implementation and can provide realistic financial projections.

The American Academy of Cosmetic Dentistry and similar specialty organizations often have study clubs focused on fee-for-service practice models. These peer groups provide ongoing support and idea sharing during transition.

Consultants and Coaches: Practice management consultants like The Profitable Dentist, Fortune Management, and Breakthrough Practice Solutions specialize in fee-for-service transitions. They provide systematic approaches, financial modeling, and ongoing coaching during implementation.

Choose consultants with documented success helping practices similar to yours. Ask for specific case studies and references from practices that completed transitions within the past two years.

Technology Partners: Practice management software companies like Dentrix, Eaglesoft, and Open Dental offer modules designed for fee-for-service practices. These tools streamline billing, payment processing, and financial reporting for practices not dependent on insurance claims.

Membership plan platforms like Kleer, BoomCloud, and Dental HQ provide turnkey solutions for implementing subscription-based patient programs. These services handle enrollment, billing, and customer service, allowing practices to focus on care delivery.

One client summarizes the action-oriented approach: “We spent three months analyzing whether to transition to fee-for-service. Finally, I realized we were spending more time studying the decision than it would take to implement it. We started with one insurance plan termination and learned by doing. Six months later, we wish we’d started sooner.”

The key insight: perfect information doesn’t exist, but good enough information combined with action produces results. Practices that succeed are those that start moving based on available data rather than waiting for certainty that never comes.

Your next step isn’t necessarily dropping insurance contracts immediately—it’s taking one concrete action this week that moves you toward greater practice autonomy and financial control. Whether that’s analyzing your current contracts, researching local competition, or having honest conversations with your team, movement creates momentum that leads to meaningful change.

Additional Common Concerns (FAQs):

“What if my overhead is too high for fee-for-service?” Calculate whether your overhead reflects necessary investments in quality care or inefficient operations. Fee-for-service often reveals overhead bloat that insurance write-offs previously masked.

“How do I explain this to patients without sounding greedy?” Focus on benefits to patients: better materials, more time, no insurance delays, treatment based on need rather than coverage. Frame it as practice evolution rather than business decision.

“What about emergencies and new patients?” Develop clear policies for handling urgent care and new patient situations. Many practices offer payment plans or financing for unexpected treatment needs.

The key insight from these frequently asked questions: most concerns about fee-for-service transition stem from unfamiliarity rather than genuine obstacles. Practices that address these questions systematically—through planning, legal compliance, and clear communication—find the transition more manageable than anticipated.

Your specific situation will raise unique questions not covered here, but the general principles remain consistent: plan thoroughly, communicate clearly, and focus on providing value that justifies appropriate fees. The practices that succeed are those that work through concerns systematically rather than letting fear prevent action.

A Final Word: The Road To FFS Success Starts With What You Do NOW

Insurance companies are strangling your practice slowly, and waiting won’t make it better. Every month you delay transitioning to fee-for-service, you’re accepting lower reimbursements while your costs continue rising.

The math doesn’t work, and it’s getting worse.

But here’s what you now know that most dentists don’t: fee-for-service transition isn’t a leap of faith. It’s a systematic process with predictable outcomes when executed properly.

You’ve seen the roadmap, the timelines, and the solutions to common obstacles. The question isn’t whether this transition works—thousands of practices prove it does. The question is whether you’re ready to reclaim control of your practice.

The dentists who make this change successfully aren’t necessarily smarter or more business-savvy than you. They’re simply willing to trade short-term uncertainty for long-term autonomy. They choose temporary discomfort over permanent mediocrity.

Your practice deserves better than insurance company interference in your clinical decisions. Your patients deserve treatment recommendations based on their needs, not coverage limitations. And you deserve compensation that reflects your expertise and the value you provide.

The roadmap exists. The strategies work. The only variable is your willingness to start.

Ready to take control of your practice’s future?

Stop letting insurance companies dictate your fees and treatment decisions. Get your personalized Dental Practice Roadmap that shows so you know where you stand against your competitors.

Your patients are waiting for the best care you can provide.

Your practice deserves financial freedom.

The time to start is today right now.

10+ year content strategist, writer, author, and SEO consultant. I work exclusively with dental practices that want to grow and dominate their local areas.