Let me tell you something most dental consultants won’t.

You know that “successful” practice down the street? The one seeing 40 patients a day, booked solid for months, with three hygienists running at full capacity? The owner is going broke.

I know because I’ve seen the books.

Revenue looks great on paper—$1.8 million annually.

Impressive, right?

Except after PPO write-offs, administrative costs, and the hamster wheel of volume-based care, the owner took home less than most of his employees made last year.

He’s not alone. And neither are you.

Here’s what nobody talks about at dental conferences: PPO participation doesn’t just reduce your fees by 30-60%. That’s kindergarten math.

The real cost—the number that’ll make you question every contract you’ve ever signed—is closer to 70-80% of what you should be earning.

Think I’m exaggerating? Stick around.

I’m going to show you the true cost of PPO for dentists. I’m about to show you exactly where your money goes, why that steady stream of PPO patients is quietly bankrupting your practice, and how dentists who figured this out are now working fewer hours while making significantly more.

But first, let’s destroy the biggest lie in dentistry: that you need PPOs to survive.

You don’t.

They need you.

And they’re getting rich while you get busy.

Key Takeaways

- PPOs drain 70–80 % of your potential earnings once true costs surface.

- Chasing volume under PPOs means busier schedules but slimmer profits and burnout.

- Hidden admin hassles quietly bleed six-figure sums every year.

- Annual fee cuts plus inflation snowball into multi-million-dollar lifetime losses.

- Act now: refine status quo, drop bad PPOs, or go fee-for-service—start with a 7-day cost audit.

Table of Contents

The PPO Lie Everyone Believes

Walk into any dental practice and ask the owner why they participate in PPO networks. You’ll hear the same script every time:

“PPOs bring me steady patients.”

“I need the patient flow.”

“It’s predictable income.”

“Everyone else is doing it.”

Every word is a lie. Not an intentional lie—these dentists genuinely believe what they’re saying.

But it’s still wrong.

Why PPO’s Don’t Bring You Patients

The truth is that PPOs don’t bring you patients. They bring you customers. There’s a massive difference.

Patients choose you because they trust your expertise, value your care, and want the best treatment available.

Customers choose you because their insurance card works at your office. Guess which one disappears the moment you’re not the cheapest option on their plan?

Loyalty vs. Convenience: The Fatal Mistake

That “steady flow” you’re so grateful for? It’s not loyalty—it’s convenience. And convenience is the enemy of profitability.

The “predictable income” myth is even more dangerous. Yes, you can predict you’ll be busy. You can also predict you’ll be working twice as hard for half the profit.

That’s not predictable income.

That’s predictable burnout.

Why “Predictable Income” Is a Dangerous Myth

But here’s the part that should really upset you: while you’re grateful for the “opportunity” to participate in their network, PPO companies are using your desperation against you.

They know you believe you need them more than they need you. So they squeeze. Every year, a little tighter.

The average revenue for PPO practices is approximately 30% lower than FFS-based practices.

Fee reductions disguised as “market adjustments.” New administrative requirements that cost you time and money. Delayed payments that hurt your cash flow. Treatment limitations that turn you into a technician instead of a doctor.

You’re not building a practice—you’re running an insurance processing center that happens to have dental chairs.

The real kicker? Most PPO dentists are trading dollars for pennies and calling it good business. They’re so focused on staying busy that they never stop to calculate what busy actually costs them.

Time to change that conversation.

Direct Financial Hits – The Numbers That’ll Make You Sick

Let’s talk about money.

Real money.

Not the fake revenue numbers you tell yourself make PPO participation worthwhile.

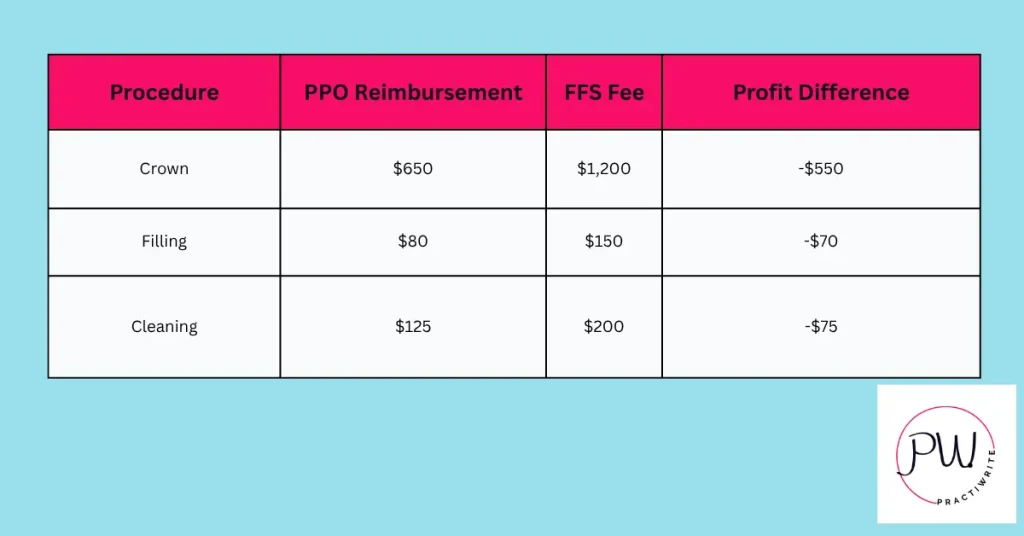

Crown Example: The True Cost of PPO

You think you understand PPO costs because you see the fee reductions.

Your $1,200 crown becomes $750 with Delta Dental.

Your $200 cleaning drops to $125 with MetLife.

You call it a 30-40% reduction and convince yourself it’s the cost of doing business.

You’re wrong. And that mistake is costing you hundreds of thousands of dollars every year.

Here’s what actually happens when you accept that PPO crown:

- Your fee: $1,200

- PPO “allowable”: $650 (46% reduction)

- Your lab bill: $200

- Staff time (2 hours at $30/hour): $60

- Materials and overhead: $140

- Total costs: $400

- Your actual profit: $250

But wait—it gets worse. Your fee-for-service patients would have paid the full $1,200, giving you $800 in profit. So you didn’t just lose $550 in revenue. You lost $550 in profit potential.

Now multiply that across every PPO procedure you do.

For a practice doing 500 crowns per year, that’s $275,000 in lost profit.

Annually.

Just on crowns.

But crowns aren’t the only procedure getting massacred. Every root canal, every bridge, every filling gets the same treatment. By the time you factor in all procedures, most PPO practices are writing off $400,000-$600,000 per year compared to fee-for-service rates.

Still think that 30-40% reduction isn’t so bad?

The $6.2 Million Wake-Up Call

Here’s the math that should keep you awake at night: if you’re writing off $500,000 annually, and PPO contracts typically include 2-3% fee reductions each year, you’re not just losing half a million this year.

Over the next decade, assuming modest 3% inflation and 3% annual PPO cuts, your total lost revenue exceeds $6.2 million.

Six. Point. Two. Million. Dollars.

And that’s just the visible money. That’s not counting the lab that doesn’t give you PPO discounts, the rent that doesn’t care about your insurance write-offs, or the staff salaries that keep rising while your per-procedure revenue keeps falling.

One practice owner in Texas calculated his annual PPO write-offs at $540,000. His fixed costs? $480,000. He was essentially working for free eleven months out of the year just to break even.

The twelfth month—if he was lucky—was his actual profit.

This isn’t sustainable. It’s not even rational. But it’s exactly what millions of dentists do every single day, convincing themselves they’re running successful practices while they slowly go broke.

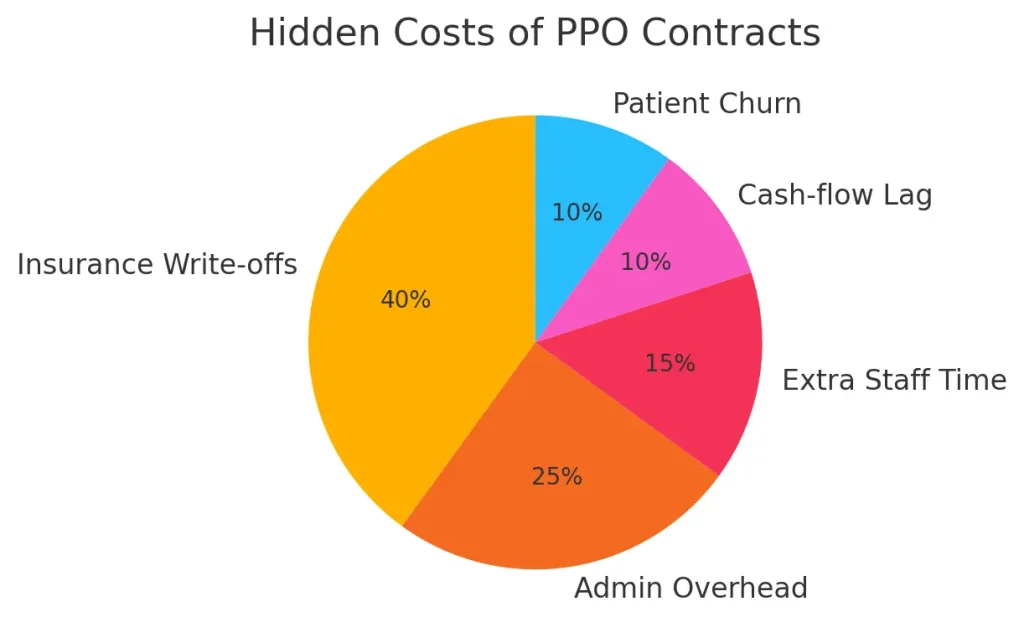

Hidden Costs That Are Killing You Slowly

The fee reductions are just what they want you to see. The real money drain happens in the shadows—death by a thousand administrative cuts that most dentists never bother to calculate.

You know that sinking feeling when your front desk tells you they spent three hours on hold with Cigna yesterday? That’s not just frustration—that’s $90 in lost productivity.

Multiply that by every insurance hassle, every week, and you’re looking at $15,000-$20,000 annually just in phone time.

But phone calls are kindergarten compared to the real administrative nightmare.

Administrative Hell: Phones, Pre-Auths, Denials

Pre-authorization hell is where practices go to die. Every major procedure requires approval from someone who’s never touched a dental instrument.

Your treatment coordinator spends 30 minutes documenting, submitting, and following up on each request. At $25 per hour, that’s $12.50 per pre-auth. For practices doing 200 major procedures annually, that’s $2,500 just in submission time.

Then they deny 40% on first submission. Now you’re doing appeals, gathering additional documentation, making phone calls.

What started as $12.50 becomes $45-$60 per approved procedure.

And some never get approved at all.

One client in Ohio tracked this for six months. His findings? The practice spent 127 hours on pre-authorizations that generated $89,000 in approved treatments.

Cost of those hours? $3,175. But here’s the kicker—they also spent 73 hours on denials and appeals that generated zero revenue. Total administrative cost: $5,000 to collect $89,000.

That’s before we talk about claims processing.

Claims Processing Costs: Time and Trust Lost

PPO practices see 15-25% initial claim denial rates. Every denial triggers a 20-30 minute investigation.

Was it coded wrong?

Missing documentation?

Coordination of benefits issue?

Your staff becomes insurance detectives instead of patient care coordinators.

The hidden cost here isn’t just time—it’s opportunity cost. Every hour spent fighting with insurance companies is an hour not spent on treatment planning, patient education, or revenue-generating activities. It’s an hour not spent making your practice better.

Technology costs multiply the bleeding. PPO contracts require specific software, regular updates, and compliance monitoring.

You’re paying for systems to manage relationships that are costing you money. It’s like paying for a rope to hang yourself.

Staff Turnover: Burnout by Insurance

Staff turnover accelerates under PPO pressure. When your team spends half their day dealing with insurance bureaucracy instead of helping patients, they burn out. Fast.

The average cost of replacing a dental team member? $75,000 when you factor in recruitment, training, and lost productivity.

High-performing practices lose 2-3 team members annually to PPO burnout. That’s $150,000-$225,000 in turnover costs. Every year. Forever.

Case Study: $241K in Hidden Costs

Here’s a real example: One practice in Phoenix tracked every PPO-related administrative cost for 12 months. The results were nauseating:

- Phone time with insurance: $18,500

- Pre-authorization processing: $21,000

- Claims management and appeals: $31,000

- Additional software and compliance: $12,500

- Extra training for constant rule changes: $8,000

- Turnover costs (2 team members): $150,000

- Total hidden costs: $241,000

That’s nearly a quarter million in costs that never show up on your P&L as “PPO expenses.” They’re buried in payroll, scattered across overhead categories, invisible until you actually calculate them.

This practice was writing off $420,000 in direct PPO fee reductions. Add the hidden costs, and his total annual PPO expense hit $661,000. For a practice grossing $1.4 million, that’s 47% of revenue going to subsidize insurance companies.

And it gets worse every year.

The Volume Trap – Why Seeing More Patients Makes You Poorer

Here’s where most dentists make their fatal mistake. PPO margins are thin, so the obvious solution seems to be volume.

See more patients.

Book tighter schedules.

Add evening hours.

Work Saturdays.

Pack those operatories like sardine cans and make up for low margins with higher patient counts.

It’s logical. It’s also financial suicide.

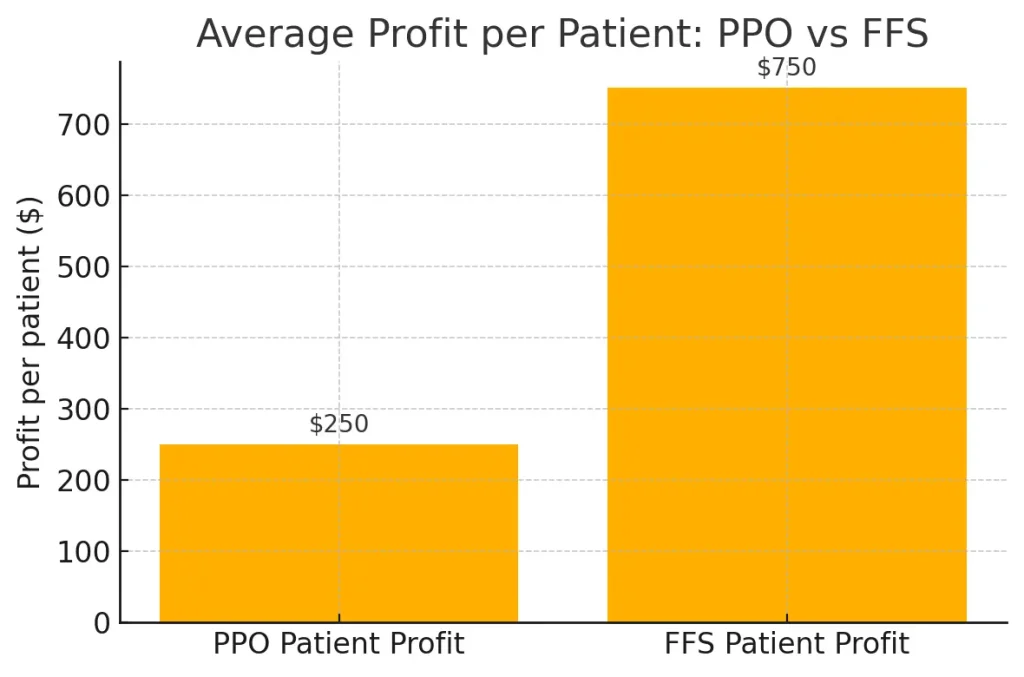

Why More Patients = Less Profit

The volume game is rigged against you from the start. Every additional patient you squeeze into your schedule costs you money in ways you’re probably not calculating.

Let’s start with the obvious: rushed care kills case acceptance. When you’re scheduling 8-minute exams because you need to see 35 patients a day, you’re not doing comprehensive dentistry—you’re doing screening exams.

You miss opportunities.

You rush diagnoses.

You can’t build the relationships that lead to treatment acceptance.

Case Acceptance Plunge from Short Visits

Fee-for-service practices average 60-80% case acceptance on treatment plans over $1,000. PPO volume practices? 30-40%.

When you’re rushing patients through like cattle, they feel it. They don’t trust rushed recommendations.

They postpone treatment. They seek second opinions elsewhere.

One practice tracked this religiously. When they scheduled 12-minute hygiene appointments, case acceptance dropped 23% compared to 15-minute appointments.

The time savings? Three minutes per patient.

The revenue loss? $180,000 annually.

But case acceptance is just the beginning of the volume death spiral.

Burnout and Equipment Breakdown

Your team burns out faster when they’re running between operatories all day. Stressed teams make more mistakes.

More mistakes mean more redo work, more complaints, more time spent managing problems instead of delivering care. Soon you’re working harder just to maintain the same quality level you used to deliver easily.

Equipment takes a beating when you’re running at maximum capacity. That dental chair rated for 8 hours of daily use? You’re pushing it 10-12 hours.

Maintenance costs skyrocket. Equipment fails more frequently. Downtime becomes a financial disaster when you’re booked solid.

The hidden cost everyone misses? Opportunity cost of different patient types.

Opportunity Cost of Saying Yes to the Wrong Patient

Every PPO patient taking up chair time is a fee-for-service patient you can’t see. Every 15-minute cleaning at $125 is a potential cosmetic consult at $2,000 you’re turning away. Every rushed crown prep is a full-mouth reconstruction you don’t have time to properly present.

One of my clients learned this lesson the hard way. Her practice was seeing 45 patients daily across 8 operatories. Busy as hell, revenue looked good on paper—$2.1 million annually.

But when she calculated her true hourly rate, including all the hidden costs of volume, she was making $47 per hour. Less than her hygienists.

The breaking point came when she realized she hadn’t done a comprehensive exam in six months. Every patient was either maintenance or emergency.

No treatment planning.

No relationship building.

No professional satisfaction.

Here’s the math that changed everything for her: 45 PPO patients daily generated an average of $115 profit per patient after all costs. Total daily profit: $5,175.

When she cut back to 25 patients daily and raised her standards, average profit per patient jumped to $280. Total daily profit: $7,000. She was making 35% more money working with 44% fewer patients.

The volume trap isn’t just about money—it’s about what kind of dentist you become.

When you’re chasing numbers instead of practicing dentistry, you stop being a healthcare provider and become a production machine. Your job satisfaction plummets. Your skills atrophy. Your reputation suffers.

Worst of all, you train your patients to expect rushed, commodity-level care. They stop seeing you as a professional and start seeing you as a service provider. Once that happens, they’ll leave you for anyone who’s $10 cheaper.

Volume doesn’t solve the PPO problem. It amplifies it.

What You’re Really Losing – The Stuff That Matters

The money is bad enough. But PPO participation costs you things that can’t be measured in dollars—things that matter more than your bank account.

Let’s start with the big one: you’re not practicing dentistry anymore. You’re processing insurance claims that happen to involve teeth.

When was the last time you recommended the best treatment for a patient without first checking their coverage?

When did you last suggest a premium material because it was clinically superior, not because insurance would pay for it?

When was the last time you practiced medicine instead of practicing insurance?

PPO contracts don’t just limit your fees—they limit your professional judgment. You can’t recommend what you know is best because some claims processor in Des Moines decided it’s “not medically necessary.” You’re not a doctor making medical decisions. You’re a technician following insurance protocols.

That crown that needs replacement? The insurance company says it hasn’t been five years yet, so you wait.

The cosmetic case that would change a patient’s life? Not covered, so you don’t even mention it.

The premium materials that last twice as long? Sorry, insurance only covers amalgam.

You went to dental school to help people. Now you help insurance companies save money by providing the cheapest acceptable care.

Your practice value is getting destroyed in the process. When you sell your practice, buyers don’t just look at revenue—they look at profit margins, patient dependency on insurance, and growth potential. PPO practices check all the wrong boxes.

Here are the numbers that’ll make you sick: comparable fee-for-service practices sell for 20-30% more than PPO practices. If your practice is worth $800,000 as a PPO mill, it could be worth $1.1 million as a fee-for-service practice. That’s $300,000 you’re losing at retirement because you accepted reduced fees for 20 years.

But the real cost is what PPO participation does to your life.

Remember why you became a dentist? Probably wasn’t to work 60-hour weeks seeing patients every 8 minutes while drowning in insurance paperwork. But that’s where most PPO practices end up.

The volume demands mean longer days. The administrative burden means working weekends. The financial pressure means you can’t afford the staff or systems that would make your life easier. You’re trapped in a cycle where working more is the only way to maintain income, but working more makes you miserable.

One practice owner I spoke with put it perfectly:

“I was making good money on paper, but I hadn’t taken a real vacation in three years. I was working Saturdays, seeing 40 patients a day, and going home exhausted every night. My wife said I’d become a stranger to my own family. What’s the point of a successful practice if it destroys everything else you care about?“

The professional identity crisis runs deeper than most dentists want to admit. You spent eight years becoming a doctor, but PPO contracts reduce you to a commodity provider.

Patients don’t choose you for your expertise—they choose you because you’re on their plan. You’re not Dr. Smith, the skilled restorative dentist. You’re “the guy my insurance covers.”

That erodes something fundamental about professional pride and purpose.

You stop improving your skills because insurance doesn’t pay for excellence—it pays for adequacy.

You stop investing in advanced training because patients won’t pay extra for advanced techniques.

You become what your insurance contracts reward: average.

The worst part? This isn’t temporary. Every year you stay in PPO networks, these patterns become more entrenched.

The longer you accept reduced autonomy, reduced income, and reduced professional satisfaction, the harder it becomes to imagine any alternative.

You start believing you can’t survive without PPOs. You convince yourself that being busy means being successful. You accept that being tired, frustrated, and financially stressed is just the price of being a dentist.

It’s not. You’re just doing it wrong.

Real Case Study – Dr. Regina’s $920K Annual PPO Cost

A client of mine here in Ohio thought she was running a successful practice. $1.8 million in annual revenue.

Eight operatories.

Booked solid for months.

Three hygienists working at capacity.

By every external measure, she was crushing it.

Except she was going broke.

She came to me after her accountant delivered some sobering news: despite record revenue, her practice had generated less profit than the previous year.

Again.

For the third year running.

She was working harder, seeing more patients, and taking home less money.

“I don’t understand it,” she said. “We’re busier than ever.”

I understood it perfectly. Regina was trapped in the PPO death spiral, and she didn’t even know it. Here’s what her books looked like when we started the audit:

- Annual Revenue: $1,800,000

- PPO Patient Percentage: 85%

- Average Daily Patient Count: 42

- Doctor Working Hours: 55 per week

Those numbers look impressive until you dig deeper.

The Direct Hit: Her standard fees totaled $2.34 million annually. Her PPO reimbursements? $1.26 million. Direct write-offs: $540,000.

That’s half a million dollars she was giving away just to stay “in network.” But that was only the beginning.

The Hidden Bleeding: We tracked every PPO-related cost for six months, then projected annually:

- Administrative time (pre-auths, claims, appeals): $89,000

- Extended phone time with insurance companies: $23,000

- Additional compliance and software costs: $18,000

- Extra staff training for constant rule changes: $12,000

- Equipment wear from high-volume scheduling: $21,000

- Staff turnover costs (3 team members that year): $225,000

- Total hidden costs: $388,000

The Opportunity Cost: This was the killer. This client was so busy with PPO patients that she couldn’t see fee-for-service patients. We calculated she was turning away approximately $200,000 annually in fee-for-service revenue because she didn’t have chair time available.

Total Annual PPO Cost: $920,000

Nearly a million dollars. Gone. For the privilege of being “preferred providers” for insurance companies that were slowly strangling her practice.

Regina’s take-home after all expenses? $127,000. She was working 55-hour weeks to make less than many of her employees.

“This can’t be right,” she said when I showed her the numbers.

It was right. And it was about to get worse, because PPO contracts included 3% annual fee reductions.

The Transformation: Regina and I developed an 18-month strategic plan to transition her practice. Not cold turkey—that would have been financial suicide. But systematic, deliberate change.

Months 1-6: We dropped the three worst-performing PPO contracts. These represented 15% of her patients but only 8% of her profit. We used the freed capacity to focus on comprehensive treatment planning for remaining patients.

Months 7-12: We eliminated two more PPO contracts and began marketing to fee-for-service patients. Regina invested in practice upgrades—better technology, enhanced patient experience, staff training in consultative treatment planning.

Months 13-18: We terminated the remaining low-performing contracts, keeping only two high-reimbursing plans that represented genuine value.

The Results After 18 Months: Annual Revenue: $1,400,000 (22% lower)

- PPO Patient Percentage: 35%

- Average Daily Patient Count: 28 (33% fewer patients)

- Doctor Working Hours: 42 per week

- Take-Home Profit: $380,000 (199% increase)

Read that again. She made $253,000 more per year while working 13 fewer hours per week and seeing 14 fewer patients per day.

Her profit per patient jumped from $3,024 to $13,571. Her stress level plummeted. Her team turnover dropped to zero. Patient satisfaction scores increased dramatically because she finally had time to provide the care she’d always wanted to deliver.

What She Wished She’d Known: “I thought I needed PPOs to fill my schedule,” Regina told me six months after the transition. “But I was filling my schedule with the wrong patients. I was working twice as hard for half the profit, and I convinced myself that was normal.“

“The scariest part wasn’t losing patients—it was realizing how much of my professional life I’d wasted chasing insurance reimbursements instead of practicing dentistry.”

Regina’s story isn’t unique. It’s just unusual that someone actually calculated the real costs and had the courage to change course.

Most dentists never do the math. They stay busy, stay stressed, and stay broke, convincing themselves they’re successful because their schedules are full.

My client broke free. So can you.

The Compound Effect – How PPO Costs Multiply Over Time

Here’s the part that should terrify you: everything I’ve shown you so far gets worse every single year.

PPO contracts aren’t static. They’re designed to squeeze harder over time, and most dentists never notice because the strangulation happens slowly.

The Slow Death of Fee Reductions

Every PPO contract includes automatic fee reductions. Usually 2-3% annually, buried in the fine print as “market adjustments” or “fee schedule updates.”

You probably signed these clauses without reading them. Most dentists do.

Here’s what that means in real dollars: if you’re writing off $500,000 this year, next year it’ll be $515,000. The year after, $530,450. By year five, you’re writing off $562,754 annually. That’s an additional $62,754 in lost revenue just from automatic escalations.

But inflation doesn’t stop for PPO contracts. Your costs rise 3-4% annually—rent, salaries, supplies, lab fees, everything.

Meanwhile, your PPO reimbursements drop 2-3% annually. You’re getting squeezed from both sides.

The math is brutal.

Let’s say you start with $500K in annual PPO write-offs. Your costs increase 3% yearly, PPO fees decrease 3% yearly. After 10 years:

- Your costs have increased 34%

- Your PPO reimbursements have decreased 26%

- Your effective PPO loss is now 60% higher than when you started

You’re literally getting poorer every year you stay in these contracts.

Saturated Markets Make Things More Difficult

Market saturation makes everything worse. When you first joined PPO networks, there were fewer participating dentists.

Now? Every dentist within 10 miles accepts the same plans. Competition for the same insurance patients drives everyone toward the lowest common denominator.

PPO companies know this. They’re not stupid.

They sign up as many dentists as possible, then squeeze fees because they know you’ll compete with each other for patients. You’ve become replaceable.

The career-long impact is staggering. One dentist I spoke with ran these numbers for his own practice and nearly had a heart attack.

Over his expected 25-year career, assuming modest 3% annual fee reductions and 3% cost inflation:

- Total PPO write-offs: $18.2 million

- Additional costs from administrative burden: $6.8 million

- Opportunity costs from reduced capacity: $4.1 million

- Career-long PPO cost: $29.1 million

Twenty-nine million dollars. That’s not revenue—that’s the difference between what his practice could have earned versus what PPO participation will cost him over his career.

“I’m not just giving away money,” he said. “I’m giving away my retirement, my kids’ college funds, and my family’s financial security. For what? The privilege of being on insurance panels that treat me like a commodity?”

The Retirement Crisis

The retirement crisis among dentists isn’t an accident. It’s the predictable result of 30 years of declining PPO reimbursements.

Dentists who started their careers before managed care could retire comfortably on practice sales. Today’s PPO-dependent dentists are working into their 70s because they can’t afford to stop.

Here’s the compound effect most dentists miss: every year you wait to address this problem, the solution becomes harder and more expensive.

Year one of PPO dependency is easy to reverse. Year ten requires significant practice changes. Year twenty? You might be too financially dependent on insurance revenue to survive the transition.

The patients, staff, and systems you build around PPO volume become harder to change as time passes. Your reputation becomes “the insurance dentist.” Your referral patterns lock in. Your practice value decreases.

Time is not on your side. Every day you delay changing course, the compound effect works against you.

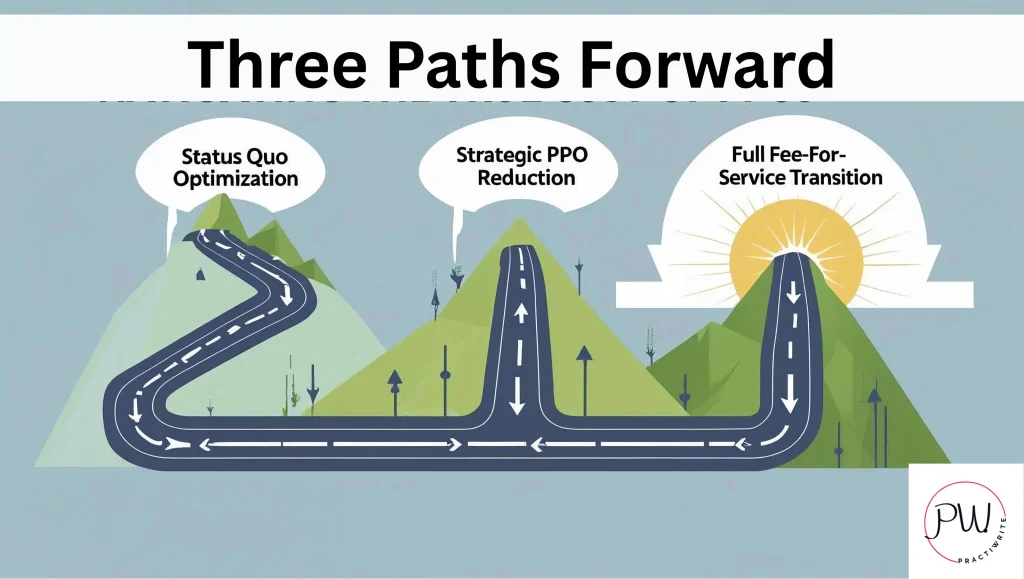

Three Paths Forward – Your Options Explained

You’ve seen the numbers. You know what PPO participation is really costing you. Now what?

You have three choices. None of them are perfect, but one of them will save your practice and your sanity. The others will just slow down the bleeding.

Path 1: Status Quo Optimization

This is the “make PPOs work better” approach. You stay in all your current contracts but implement systems to minimize the damage.

What this looks like:

- Streamline administrative processes to reduce hidden costs

- Negotiate better terms where possible (spoiler: this rarely works)

- Focus on efficiency to see more patients in less time

- Maximize case acceptance on covered procedures

The upside? It’s safe.

No dramatic changes.

No patient loss.

No scary transitions.

The downside? You’re polishing the deck chairs on the Titanic.

PPO contracts will continue squeezing you every year. The compound effect still destroys you over time. You might reduce your annual PPO costs from $500K to $400K, but you’re still giving away hundreds of thousands annually.

Best case scenario: You buy yourself 2-3 years before the pressure becomes unbearable again. This isn’t a solution—it’s a delay tactic.

Path 2: Strategic PPO Reduction

This is the “surgical strike” approach. You keep the PPO contracts that actually make sense and eliminate the ones bleeding you dry.

What this looks like:

- Audit every PPO contract for true profitability

- Drop the 20% of contracts causing 60% of your problems

- Use freed capacity for fee-for-service patients

- Gradually reduce dependency over 12-24 months

The upside? Lower risk than going full fee-for-service.

You keep some insurance patients for stability while improving your margins. Most practices can execute this without major disruption.

The math: If you’re currently 85% PPO and drop to 50% PPO over 18 months, you could see 30-40% profit increases while working fewer hours.

The downside? You’re still playing the insurance game, just with better rules. The remaining contracts will continue annual fee reductions.

You’ll always be partially dependent on insurance companies for your livelihood.

This path works well for dentists who want significant improvement without revolutionary change. It’s the middle ground that most practices should consider.

Path 3: Full Fee-for-Service Transition

This is the “nuclear option.” You eliminate all PPO contracts and build a practice based entirely on fee-for-service patients.

What this looks like:

- 12-24 month planned transition out of all insurance networks

- Complete practice repositioning and marketing overhaul

- Focus on premium care, premium experience, premium outcomes

- Patient base that chooses you for expertise, not insurance coverage

The upside? Maximum profit potential.

Complete clinical autonomy.

No administrative burden.

Work-life balance.

Professional satisfaction.

Practice value maximization.

Practices that successfully transition typically see 50-100% profit increases within 24 months, despite 20-30% revenue reductions.

The downside? Highest risk.

Significant patient loss during transition.

Requires substantial marketing investment and practice changes.

Not all markets can support full fee-for-service practices.

This path works for dentists willing to bet on themselves, their skills, and their ability to deliver value that patients will pay for directly.

The Risk Assessment: Each path carries different risks and rewards:

- Status quo: Low short-term risk, high long-term risk. Certainty of slow decline.

- Strategic reduction: Moderate risk, moderate reward. Sustainable improvement with some ongoing insurance dependency.

- Fee-for-service: High short-term risk, highest long-term reward. Maximum freedom and profit potential.

Timeline Considerations: None of these changes happen overnight. Status quo optimization takes 3-6 months to implement. Strategic reduction requires 12-24 months for full execution.

Fee-for-service transition can take 18-36 months depending on market conditions and practice positioning.

The critical factor isn’t which path you choose—it’s that you choose one. Staying on your current trajectory guarantees continued decline.

Which path fits your practice, your market, and your risk tolerance? That depends on your answers to some honest questions about where you stand today.

The Self-Assessment – Know Where You Stand

Most dentists lie to themselves about PPO profitability. They focus on gross revenue instead of net profit. They ignore hidden costs. They rationalize bad decisions because facing the truth is uncomfortable.

Stop lying. Your financial future depends on brutal honesty about where you really stand.

Here are the questions that’ll tell you everything you need to know:

Financial Reality Check

What’s your actual profit per PPO patient versus fee-for-service patient? Don’t guess—calculate it. Include all costs: lab fees, staff time, materials, administrative burden, opportunity costs. Most dentists discover their PPO patients generate 60-70% less profit than they thought.

If you don’t know these numbers, you’re flying blind. Get them. Now.

How many extra hours per week does PPO participation cost you? Track administrative time, phone calls, documentation, appeals for one month. The average PPO practice spends 15-20 hours weekly on insurance-related tasks that generate zero revenue.

That’s 800+ hours annually you could spend on patient care, practice development, or having a life.

Market Position Assessment

Can your market support fee-for-service dentistry?

Look around. Are there successful fee-for-service practices in your area? What do they charge? How busy are they?

If nobody in your market can make fee-for-service work, that tells you something important about your options.

What percentage of your new patients choose you for your expertise versus your insurance participation? Be honest. When patients call, do they ask about your qualifications or about whether you take their insurance?

If insurance coverage is the primary driver of patient selection, you’re a commodity provider, not a healthcare professional.

Professional Satisfaction Evaluation

When did you last recommend the best treatment option without first checking insurance coverage? If you can’t remember, you’ve let insurance companies take over your clinical decision-making.

How many procedures do you avoid discussing because you know insurance won’t cover them?

Cosmetic dentistry?

Premium materials?

Advanced techniques?

Every limitation you accept for insurance approval chips away at your professional autonomy.

What’s your stress level on a typical Monday morning? If the thought of facing another week of insurance hassles, rushed appointments, and administrative burden makes you want to stay in bed, you’re burning out.

Do you feel like a doctor or a technician? Insurance-driven practices turn skilled professionals into production workers. If you’re going through the motions instead of practicing medicine, something’s wrong.

Growth Potential Analysis

Where will your practice be in five years if nothing changes? Factor in annual PPO fee reductions, increasing costs, market saturation. Most PPO practices are slowly declining even when they appear busy.

What would happen to your practice if your largest PPO contract dropped you tomorrow? If the answer is “financial disaster,” you’re too dependent on insurance companies for your livelihood.

Could you survive a 30% patient loss during a transition period? Fee-for-service transitions require financial reserves and the ability to weather temporary revenue declines. If you’re living paycheck to paycheck, you need to build stability before making major changes.

The Honest Scorecard:

- If you’re profitable per PPO patient and satisfied with your professional autonomy: Status quo optimization might work short-term.

- If you’re marginally profitable but burning out from volume and administration: Strategic PPO reduction is probably your best bet.

- If you’re losing money on PPO patients or completely miserable with insurance-driven care: Fee-for-service transition is worth the risk.

The worst position? Knowing you’re losing money and professional satisfaction but being too scared to change. That’s not a business strategy—that’s slow suicide.

Most dentists never ask themselves these questions honestly because they’re afraid of the answers. But ignorance isn’t bliss when your practice is slowly bleeding to death.

You deserve better than spending your career subsidizing insurance companies while sacrificing your professional satisfaction and financial security.

A Final Word: Your Practice Is Worth More Than What PPOs Are Paying

Let’s cut through everything and get to the truth.

PPO participation is costing you more than you think. Not just the obvious fee reductions—those are bad enough. It’s the hidden administrative costs, the opportunity costs, the loss of professional autonomy, and the compound effect that gets worse every year.

You’re not failing as a dentist.

The system is rigged against you.

Insurance companies designed PPO contracts to extract maximum value from your expertise while paying you minimum fees. They’re getting rich while you work harder for less money.

The “successful” practice with packed schedules and high revenue? It’s often a mirage.

When you factor in all the real costs—administrative burden, equipment wear, staff turnover, opportunity costs, and lost autonomy—many “busy” practices are barely breaking even.

Some are even losing money.

One client was writing off $540,000 annually in direct PPO fees.

Add hidden costs and opportunity costs, and her total PPO expense hit $920,000 per year. Nearly a million dollars for the privilege of being “preferred providers.”

After her strategic transition, she made $253,000 more annually while working 13 fewer hours per week. Same skills, same market, completely different business model.

You have options. Status quo optimization if you want to minimize short-term disruption.

Strategic PPO reduction if you want significant improvement without revolutionary change.

Full fee-for-service transition if you’re ready to bet on yourself and maximize your potential.

The choice isn’t whether to address this problem—it’s which solution fits your situation and risk tolerance.

Here’s what you need to do in the next 7 days:

Day 1-2: Calculate your real PPO costs. Track every administrative minute, every write-off, every hidden expense. Get the actual numbers, not your estimates.

Day 3-4: Audit your PPO contracts. Which ones are bleeding you dry? Which ones might actually be profitable? Most practices discover 20% of their contracts cause 60% of their problems.

Day 5-6: Assess your market position. Can your area support fee-for-service dentistry? What are successful non-PPO practices in your region doing differently?

Day 7: Make a decision. Status quo, strategic reduction, or full transition. Pick a path and commit to it. Indecision is the most expensive choice you can make.

The longer you wait, the harder this becomes. Every year of PPO participation locks you deeper into insurance dependency.

Every year of reduced fees compounds into bigger losses. Every year of administrative burden and rushed care erodes more of your professional satisfaction.

You didn’t spend eight years in dental school to become an insurance processor. You didn’t build a practice to subsidize companies that treat you like a commodity. You deserve to practice dentistry on your terms, charge what your expertise is worth, and build a practice that serves your financial and professional goals.

The dentists who figure this out aren’t smarter or luckier than you. They just stopped accepting that working harder for less money was normal. They stopped believing they needed PPOs more than PPOs needed them.

Your practice is worth more than what insurance companies are paying. Your time is worth more than what PPO contracts allow. Your expertise deserves better than rushed appointments and treatment limitations.

Ready to take control of your practice’s future?

Stop guessing about your PPO costs and start making decisions based on real data. Book your free strategy session to get your Dental Practice Roadmap now. We’ll analyze your specific situation, identify your biggest profit drains, and show you where your practice stands so you can plan to transition away from insurance dependency.

No more working harder for less money.

No more letting insurance companies dictate your treatment decisions.

No more accepting that busy equals successful.

Your financial freedom starts with understanding what PPO participation is really costing you. And that understanding starts with your next decision.

Book your free strategy session to get your Dental Practice Roadmap today now.

10+ year content strategist, writer, author, and SEO consultant. I work exclusively with dental practices that want to grow and dominate their local areas.